TLDR:

- Whale wallets accumulated 30M XRP in one day as price hovered around the $2.49 range.

- Binance exchange reserves dropped below 3B XRP, signaling reduced selling pressure from holders.

- XRP broke out of a multi-year triangle, with targets now projected at $8, $13, and $27.

- Evernorth plans $1B listing; Ripple acquires GTreasury to expand XRP’s institutional finance reach.

Whale wallets holding between 100,000 and 10,000,000 XRP added 30 million XRP in the past 24 hours, according to data shared by analyst Ali Charts.

This increase in holdings took place as XRP traded near $2.49, with a 1% rise on the day. Over the past week, the price showed a minor 0.26% decline.

Daily volume reached close to $4.86 billion, suggesting steady market interest. The rise in large wallet balances during a period of price stability points to renewed activity from deep-pocketed holders.

While short-term price action remains flat, buying from these wallets often reflects preparation for a longer holding period.

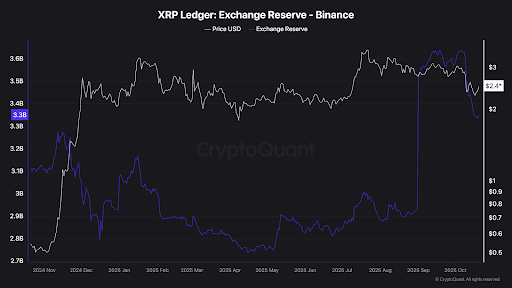

Meanwhile, data from CryptoQuant shows XRP reserves on Binance fell sharply, from above 3.5 billion to under 3 billion XRP. This drop indicates major outflows from the exchange, often linked to holders moving funds into private storage.

At the time of the drop, XRP was trading at around $2.40. Previous increases in exchange reserves have been followed by price dips, while current outflows come during stable or slightly falling prices. This may reflect a lower intention to sell among holders, aligning with the rise in whale accumulation.

XRP Technical Charts Show Key Breakouts and Levels

A long-term chart from ChartNerd shows XRP breaking out of a multi-year symmetrical triangle.

The pattern was followed by a successful retest of the 3-month EMA, which remains intact. The structure points to potential trend continuation. Based on historical patterns, the analysis sets future price zones near $8.47, $13.78, and $27.70.

Another chart by Egrag Crypto marks the $2.65–$2.70 range as an important resistance zone currently being tested. XRP recently rebounded off a trendline labeled the Bull Market Support Line, which has held multiple times in the past year.

A confirmed break above $2.70 could open the way for further upward movement. The $2.10–$2.30 area remains a major support zone.

Public Market and Treasury Developments

As recently reported by Blockonomi, Evernorth Holdings announced plans to go public through a business combination with Armada Acquisition Corp II.

If approved, the deal would raise over $1 billion and list the company under the ticker XRPN on Nasdaq. Evernorth would become the largest public firm holding XRP as a treasury asset.

Additionally, Ripple also announced a deal to acquire GTreasury for $1 billion. The firm provides treasury management systems used by institutions. Ripple plans to connect its payment platform with these systems to support real-time transactions in corporate finance.