TLDR

- Alibaba Cloud launched its second data centre in Dubai, nine years after the first, as part of a $53 billion three-year investment plan.

- The expansion aims to meet growing AI and cloud computing demand in the Middle East, with partnerships including Abu Dhabi’s Wio Bank.

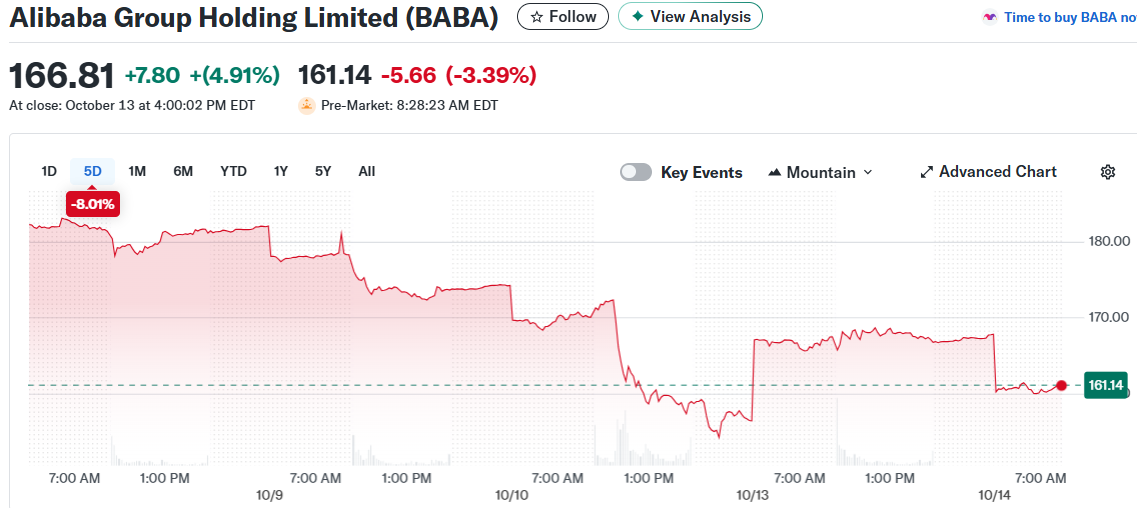

- Alibaba stock has surged over 100% year-to-date, driven by strong retail performance and AI-driven cloud services growth.

- Q1 FY26 revenue hit $34.6 billion with cloud sales jumping 26% year-over-year to reach 33.4 billion yuan.

- Analysts maintain a Strong Buy rating with 19 Buy and 2 Hold ratings, targeting a 17.69% upside to $196.32.

Alibaba Cloud opened its second data centre in Dubai on Tuesday. The facility marks the company’s latest push into Middle Eastern markets.

The expansion comes nine years after Alibaba’s first Dubai data centre. The move is part of a broader 380 billion yuan investment over three years.

Eric Wan, vice president of Alibaba Cloud International, highlighted the region’s AI adoption potential. The Middle East’s collaborative ecosystem creates opportunities for both private and public sector companies.

The timing aligns with the UAE’s heavy investment in artificial intelligence infrastructure. The country is building the largest AI campus outside the United States through partnerships with Nvidia and OpenAI.

Alibaba Cloud announced partnerships with several local companies during the GITEX Global tech exhibition. Abu Dhabi-backed digital lender Wio Bank is among the new partners.

The UAE deal, signed in May, represents a balance between American and Chinese interests. The country maintains close ties with the U.S. while China remains its largest trading partner.

However, the AI campus deal faces hurdles. Sources told Reuters the agreement hasn’t been finalized due to U.S. security concerns about Beijing’s access to advanced semiconductors through third parties.

Strong Stock Performance Draws Analyst Attention

BABA shares have climbed over 100% year-to-date. The rally reflects investor confidence in the company’s core retail business and cloud services.

TipRanks‘ AI Analyst gives Alibaba a score of 75 out of 100 with an Outperform rating. The analysis points to a price target of $179, suggesting 7.3% upside potential.

First quarter fiscal year 2026 results showed revenue of 247.7 billion yuan, equivalent to $34.6 billion. Cloud revenue jumped 26% year-over-year to 33.4 billion yuan.

The company’s strategic partnership with SAP expands its enterprise cloud market presence. The collaboration adds business tools to Alibaba’s service offerings.

Mixed Financial Signals Emerge

Lower adjusted EBITDA raises some concerns about profitability. Cash outflows for new projects continue as the company invests in growth initiatives.

The quick commerce unit posted losses. Competition in food delivery and fast-service sectors remains intense.

Wall Street analysts maintain a bullish outlook despite these challenges. The stock carries 19 Buy ratings and two Hold ratings for a Strong Buy consensus.

The average analyst price target sits at $196.32. This represents potential upside of 17.69% from current trading levels.

Alibaba’s cloud business continues expanding its global footprint while AI services drive revenue growth. The Dubai data centre launch adds infrastructure capacity to support regional demand for cloud computing and artificial intelligence applications.