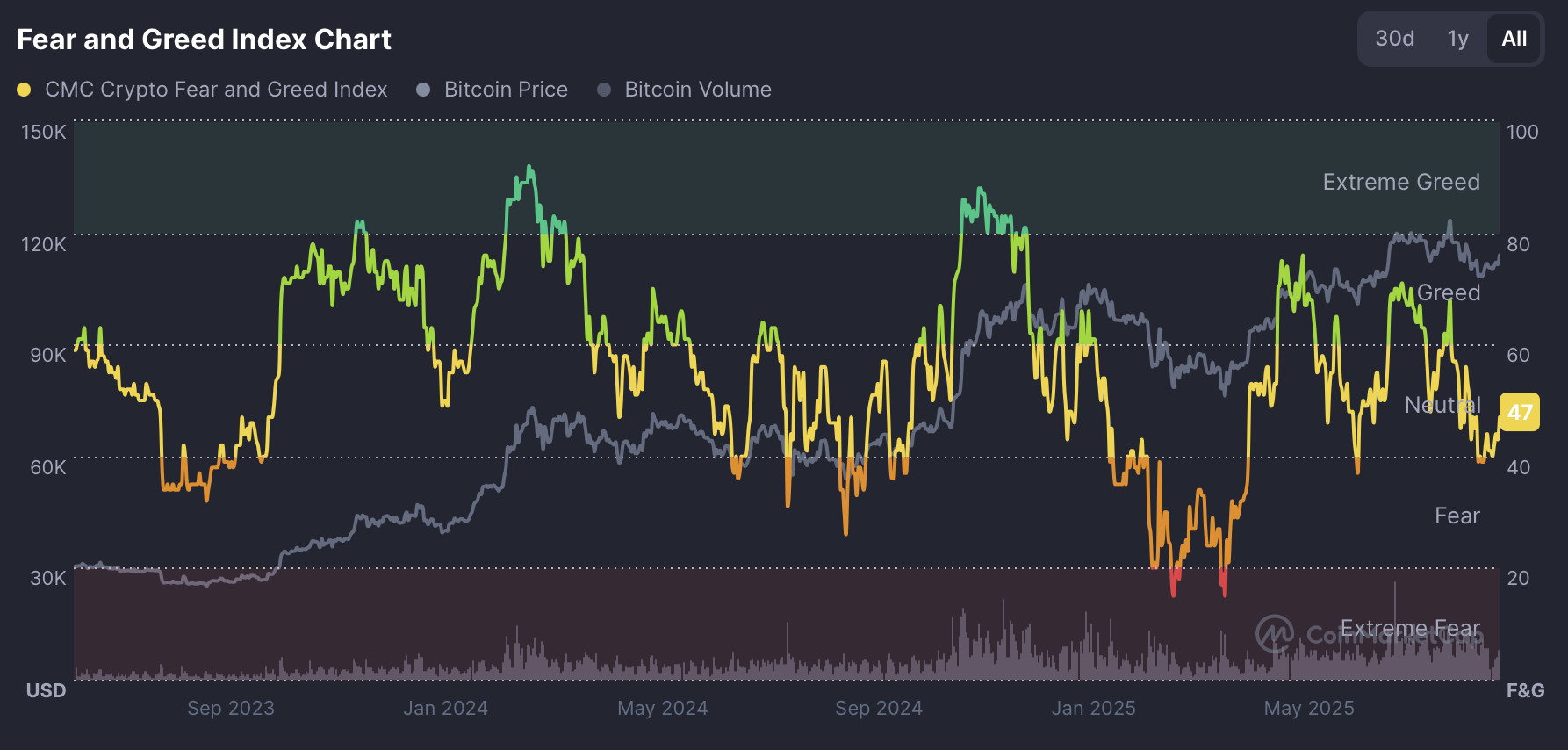

The Fear & Greed Index, one of crypto’s most-watched sentiment gauges, is sitting at 47 – a neutral zone where neither euphoria nor panic dominates. Historically, this has been the range where smart money positions early, before retail enthusiasm pushes readings higher. Analysts note that neutral sentiment often masks the quiet accumulation happening under the surface, as investors avoid extremes and focus instead on fundamentals.

Right now, three names are emerging as top picks under these conditions: Chainlink (LINK), Cardano (ADA), and MAGACOIN FINANCE. Each offers a different value proposition, infrastructure, scalability, and presale asymmetry, but all three are capturing attention for their resilience and potential upside as the market prepares for Q4 inflows.

LINK: the oracle layer powering DeFi

Chainlink has long been the backbone of decentralized finance. Its oracles deliver the real-world data that smart contracts need to function, from asset prices to weather metrics. Without LINK, much of DeFi’s infrastructure would collapse. After years of building integrations, LINK is now plugged into hundreds of protocols across multiple chains.

Recent developments, including Chainlink’s Cross-Chain Interoperability Protocol (CCIP), are expanding its reach even further, positioning LINK as a critical player in enabling tokenized assets and cross-chain finance. Analysts argue that LINK is undervalued compared to its importance in the ecosystem, making it an attractive buy during periods of neutral sentiment.

ADA: patient growth with strong community

Cardano continues to divide opinion, but even its critics acknowledge the strength of its community. Built on a philosophy of peer-reviewed research and careful iteration, ADA has often been slower to ship than competitors. Yet that deliberate pace has also created one of the most loyal investor bases in the industry.

With the rollout of decentralized governance and new identity-focused use cases, ADA is gradually expanding beyond its “slow and steady” reputation. The network now supports an active DeFi ecosystem and continues to attract developers building on its secure infrastructure. For investors looking to balance patience with long-term potential, ADA remains one of the top names to watch.

MAGACOIN FINANCE: from niche to mainstream narrative

The third name drawing attention is MAGACOIN FINANCE, and it’s not just retail chatter fueling the buzz. MAGACOIN FINANCE has left hidden-gem territory. Analysts say mainstream chatter is accelerating, with retail and institutional traders now both highlighting its presale growth. This transition from niche to mainstream narrative often signals that a project is about to jump from quiet momentum to explosive public adoption once listings begin.

Backed by a completed HashEx audit and with CertiK’s seal in progress, MAGACOIN FINANCE has already cleared the credibility hurdle that many presales fail to address. Its structured tokenomics, 60% to presale buyers, just 1% to the team, further reinforce investor trust. Add in a Telegram base of over 25,000 members and more than 13,500 verified investors, and the community scale is undeniable.

This combination of legitimacy and cultural firepower explains why analysts project upside multiples ranging from 35x to 45x. As MAGACOIN FINANCE shifts from niche conversations to mainstream narratives, investors see this as the inflection point where presale speculation turns into early-stage conviction.

Why neutral sentiment favors accumulation

Periods of neutral sentiment, like today’s 47 Fear & Greed reading, are often where the strongest allocations are made. With emotions balanced, investors can focus on fundamentals rather than reacting to hype or fear. That’s why names like LINK, ADA, and MAGACOIN FINANCE stand out – they each have measurable adoption, strong communities, and narratives that are only gaining traction.

In past cycles, altcoins that were accumulated during neutral sentiment often delivered outsized returns once Fear & Greed tilted toward greed. Ethereum in 2020, Solana in 2021, and even meme coins like PEPE in 2023 all surged after months of quiet accumulation at neutral levels. Analysts argue the same setup could be forming now.

Balancing infrastructure, community, and presales

For investors, the trio of LINK, ADA, and MAGACOIN FINANCE represents a balanced allocation across categories. LINK offers infrastructure utility, ADA provides community strength with long-term credibility, and MAGACOIN FINANCE delivers presale asymmetry with explosive upside. Together, they create exposure to stability and growth across multiple narratives.

It’s this balance that many analysts say defines smart positioning during neutral sentiment. Rather than overloading on one narrative, spreading across infrastructure, scalability, and cultural presales captures the best of each category while reducing risk.

Conclusion

With Fear & Greed holding at 47, the market is in a rare neutral phase where fundamentals matter most. LINK’s oracle dominance, ADA’s patient community-driven growth, and MAGACOIN FINANCE’s transition from niche to mainstream all make them standouts to accumulate now.

For those looking beyond short-term volatility, these three projects embody the qualities investors seek when building positions ahead of a bullish Q4. Neutral sentiment won’t last forever — and when greed returns, those already positioned may be the ones celebrating the next wave of altcoin breakouts.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.