TLDR

- Alphabet holds over 90% market share in search and is successfully integrating AI features like Circle to Search and AI Overviews to maintain dominance

- Google Cloud revenue grew 32% to $13.6 billion last quarter, with operating income more than doubling to $2.8 billion year over year

- Alphabet raised its 2025 capital expenditure budget by $10 billion to $85 billion to meet strong demand for cloud services that exceeds current capacity

- Broadcom’s AI semiconductor revenue exceeded $5 billion last quarter, representing 63% year-over-year growth and accounting for one-third of total business

- Both companies trade at relatively modest valuations despite strong growth, with Alphabet at 22-23x forward earnings and Broadcom delivering 28% annualized growth over the past decade

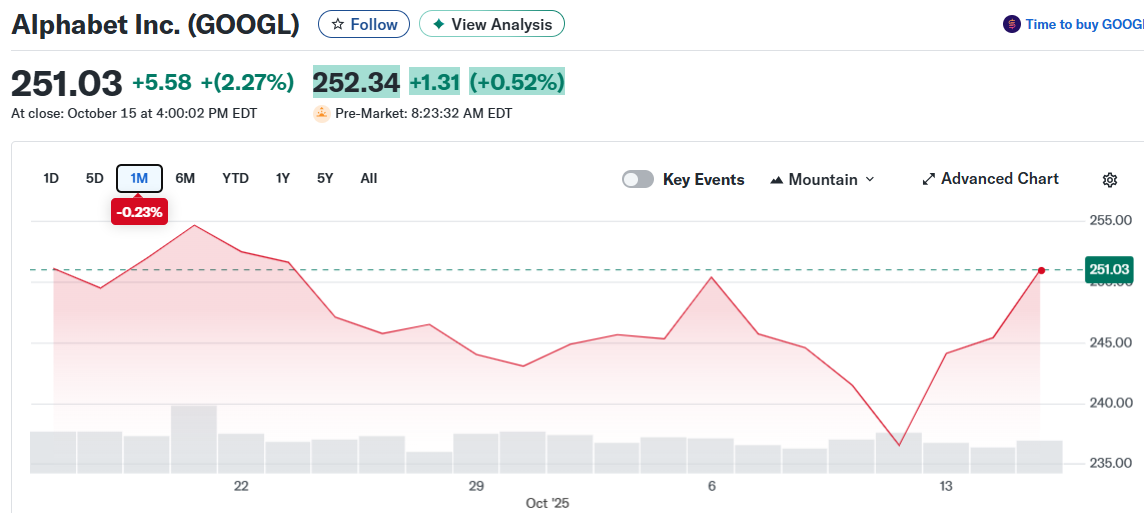

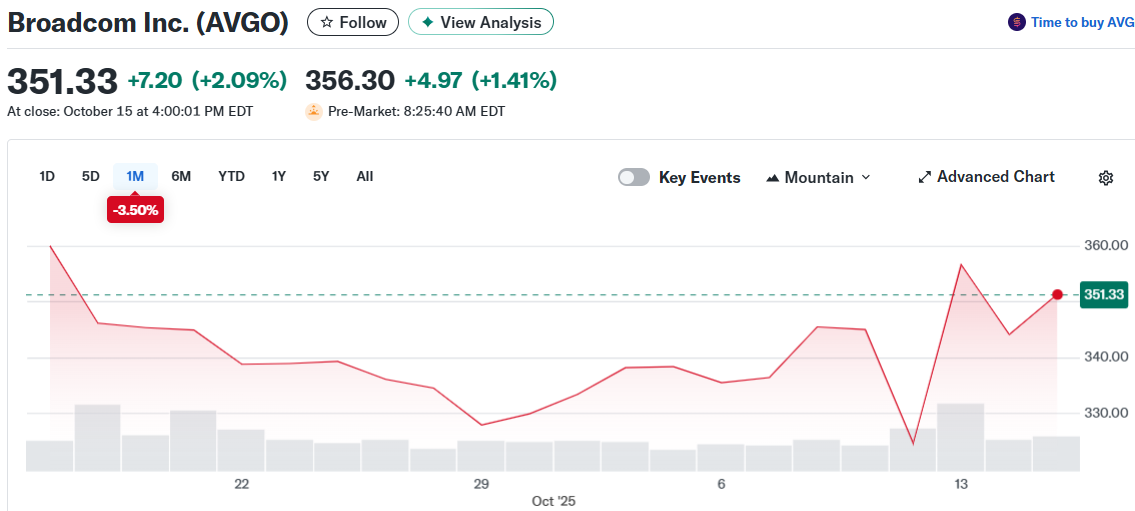

Alphabet and Broadcom are drawing investor attention as both tech giants report strong earnings growth driven by artificial intelligence demand. The two companies have reached market capitalizations of $3 trillion and $1.7 trillion respectively.

Alphabet maintains its dominant position in the search market with over 90% market share. The company’s Chrome browser and Android operating system each hold more than 70% of their markets. This gives Google control over the internet gateway for most people outside China.

The company faced concerns about AI chatbots reducing search demand. Instead, Alphabet integrated AI features across its products. New tools like Circle to Search, Lens, and AI Overviews are increasing user engagement and driving more search queries.

Cloud Computing Drives Revenue Growth

Google Cloud has become a major growth driver for Alphabet. The division reported revenue of $13.6 billion last quarter, up 32% year over year. Operating income more than doubled to $2.8 billion in the same period.

Alphabet’s cloud business benefits from vertical integration. The company developed its own Gemini large language model, custom AI-accelerator chips, data centers, software stack, and fiber network. This approach provides cost advantages and performance control that competitors struggle to match.

Demand for Google Cloud services currently exceeds available capacity. The company responded by raising its 2025 capital expenditure budget by $10 billion. The new total of $85 billion aims to expand infrastructure to meet customer needs.

AI Overviews is driving a 10% increase in global search queries. This contributes to growth in search advertising revenue. Google Cloud also reported a 28% increase in cloud customers year over year last quarter.

Alphabet is expanding into enterprise AI with Gemini for Business. This offering lets companies deploy AI agents without coding requirements. The move positions Alphabet as a direct competitor to Microsoft in corporate AI adoption.

The company trades at a forward price-to-earnings ratio under 23 based on 2026 analyst estimates. This represents a discount compared to most large-cap AI peers.

Broadcom Benefits from AI Chip Demand

Broadcom generates $60 billion in trailing revenue across its diversified semiconductor business. The company’s AI semiconductor revenue exceeded $5 billion last quarter. This represents roughly one-third of total business and showed 63% year-over-year growth.

The stock has risen 54% year to date on strong demand for custom AI accelerators. Broadcom also sells networking products that speed up data flow in data centers. The company’s market value has reached $1.7 trillion.

Broadcom’s non-AI business reported flat revenue last quarter. Management expects these markets to experience a gradual recovery starting around mid-2026. The company’s diverse product line includes components for wireless communications, servers, storage systems, and factory automation.

The VMware cloud software business also contributes to profits. Broadcom has delivered annualized growth in revenue and earnings per share of 28% over the past decade. Analysts expect earnings to continue growing at similar rates over the next several years.