TLDR:

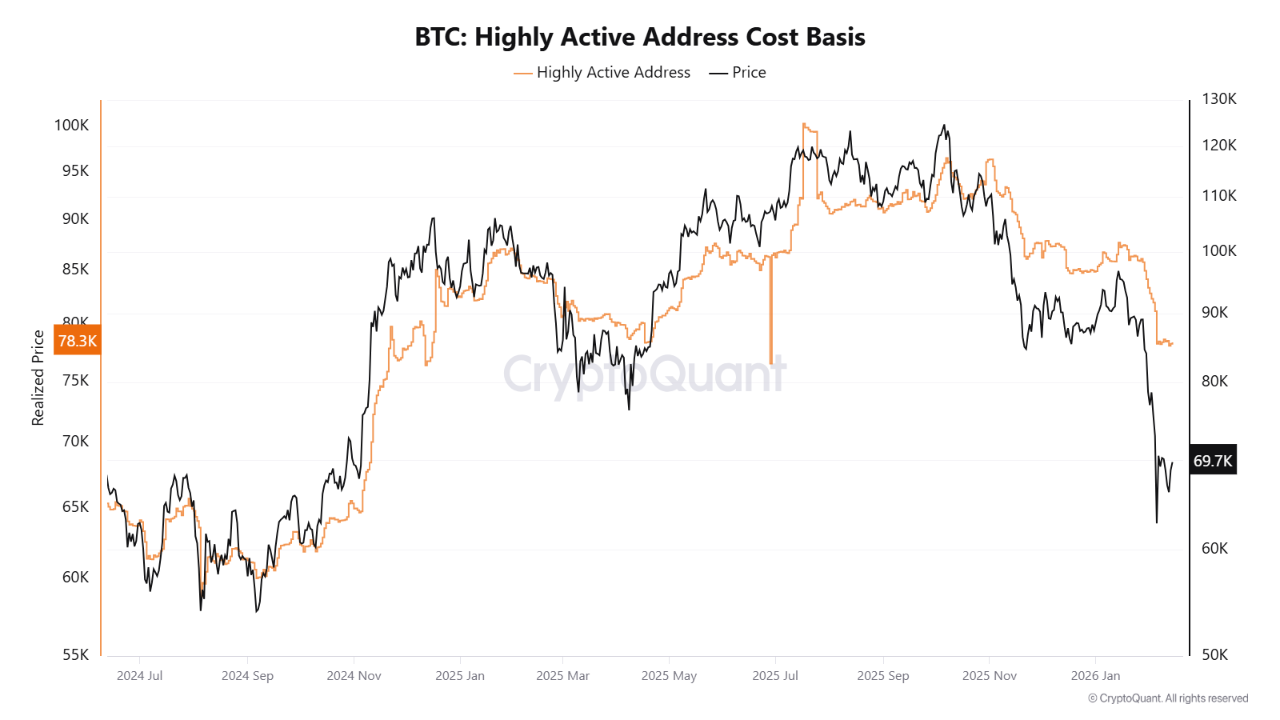

- Bitcoin currently trades below $78K, the realized price representing active addresses’ cost basis.

- Holding below this level places frequent traders underwater, shifting behavior from buying to selling.

- Sustained reclaim above $78K would return active participants to profit and reduce supply pressure.

- Failure to break resistance increases the probability of decline toward $50K long-term holder support zone.

Bitcoin trades below a structural threshold that could determine the market’s near-term direction. The cryptocurrency currently sits beneath $78,000, which represents the realized price of highly active addresses.

This level serves as a critical cost basis for participants who transact most frequently. Market observers note that price behavior around this zone will likely shape recovery prospects or signal further downside pressure.

The $78K Threshold as Market Divider

Bitcoin’s realized price for highly active addresses stands near $78,000 at present. This metric reflects the aggregate cost basis of market participants who respond quickly to changing conditions.

Unlike static technical levels, this threshold represents actual positioning and sentiment among active traders. The realized price functions as a behavioral marker rather than a simple chart reference.

Spot price currently trades below this realized level across major exchanges. This positioning places highly active addresses in unrealized losses on average.

Market structure shifts when participants hold underwater positions relative to their entry points. The change alters trading behavior from accumulation toward distribution as holders seek exits.

Trading below the $78K realized price historically increases overhead supply during rally attempts. Active addresses shift from absorbing sell pressure to contributing to it.

Source: Cryptoquant

Each move higher faces resistance from participants looking to reduce exposure near breakeven. The dynamic transforms what might otherwise serve as support into a supply zone.

The transition from support to resistance carries weight for short-term price action. Recovery attempts meet sellers who entered at higher levels and now seek liquidity.

This pattern reinforces the $78K zone as a divider between market phases. Acceptance below this level suggests continued pressure until equilibrium shifts.

Path Forward and Downside Risk

Market recovery requires the price to reclaim and hold above the $78K realized price. A successful breakout would return highly active addresses to profitability on average.

This shift reduces the incentive to distribute on strength and allows demand to stabilize. Sustained acceptance above this threshold validates the bullish case for continuation.

Reclaiming $78K would materially alter the market structure by removing a layer of supply. Profitable positions among active traders typically reduce selling pressure during subsequent advances.

The change allows price to build on higher ground without constant resistance. Recovery from above this level tends to show better follow-through than rallies from beneath it.

Repeated failures to break above $78K carry asymmetric downside risk for current holders. Each unsuccessful attempt reinforces the zone as distribution territory and weakens buyer conviction.

The pattern increases the probability that the price will seek the next major realized anchor. Technical structure deteriorates when key levels repel multiple breakout attempts.

The next dominant realized price sits near $50,000, corresponding to the long-term holder cost basis. This lower threshold represents participants with stronger conviction and lower propensity to sell.

Price typically finds more durable support at long-term holder levels due to reduced panic selling. A move toward $50K would mark deeper mean reversion before sustainable bottoming patterns can emerge.