TLDR

- A survey reveals that 68.44% of respondents believe Bitcoin will reach $100,000 in 2024, with a steady flow of Bitcoin ETFs being the key factor

- Over 66% of respondents are inclined to invest in Bitcoin, considering the potential $100,000 price target

- Technical analysis suggests that if Bitcoin closes above the $69,330 resistance level, it could trigger a rally to $74,400

- On-chain data shows increasing trading activity and demand for Bitcoin, with a significant demand zone between $66,900 and $68,900

- Bitcoin transaction value hit a yearly high of over $25 billion on May 28, despite the number of transactions remaining relatively normal

The question of whether Bitcoin will reach $100,000 in 2024 has been a topic of much speculation.

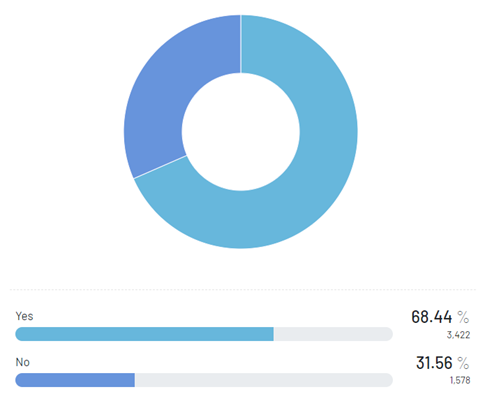

A recent survey conducted by Real Research sheds light on public sentiment regarding this milestone, with 68.44% of respondents believing that Bitcoin will indeed hit the six-figure mark by the end of the year.

The survey also delved into the factors that could contribute to Bitcoin’s price surge.

A majority of respondents (27.18%) believe that a steady flow of Bitcoin exchange-traded funds (ETFs) could be the key to reaching $100,000. Other factors cited include an increase in institutional investment, positive regulatory developments, and the possibility of cutting global interest rates.

Despite the potential risks associated with investing in a volatile asset like Bitcoin, over 66% of respondents expressed a strong inclination towards investing in BTC, considering the potential $100,000 price tag.

This bullish sentiment extends beyond the short-term, with 64.8% of respondents agreeing with MicroStrategy’s long-term prediction of a $600,000 Bitcoin by 2026.

Technical analysis also supports the bullish outlook for Bitcoin. Prominent crypto market analyst Ali Martinez highlighted a symmetrical triangle pattern on Bitcoin’s chart, suggesting that if BTC manages to close above the $69,330 resistance level, it could trigger a rally to $74,400.

This analysis points to significant potential for upward movement if Bitcoin can maintain its momentum and break through the crucial resistance level.

Further supporting the bullish sentiment, on-chain data from IntoTheBlock indicates increasing trading activity and demand for Bitcoin.

The platform identified a significant demand zone between $66,900 and $68,900, where more than 2 million addresses have accumulated around 1.1 million BTC. This accumulation suggests strong support and a solid foundation for potential price increases.

Bitcoin’s transaction value reached a yearly high on May 28, with holders moving over 367,000 BTC, worth more than $25 billion.

While the number of transactions remained relatively normal compared to other days, the high transaction value reflects the growing interest and activity in the Bitcoin market