TLDR

- BYD announced its largest-ever recall of over 115,000 vehicles due to design faults and battery safety risks, causing stock to drop nearly 4.5% in Hong Kong trading

- The recall includes 44,535 Tang series SUVs (2015-2017) with design issues and 71,248 Yuan Pro EVs (2021-2022) with battery installation problems that could raise fire risks

- This marks BYD’s fourth major recall in recent months, following previous recalls in January and September 2024 involving nearly 104,000 vehicles with fire and steering concerns

- Despite the 32% stock decline from May highs, Morgan Stanley maintains a Moderate Buy rating with analysts projecting 68-89% overseas growth in 2026

- Wall Street analysts have a consensus average price target of $24.90, implying 80.83% upside potential from current levels

BYD shares tumbled in Hong Kong trading after the company filed its biggest recall to date. The Chinese EV maker will pull back over 115,000 vehicles from roads.

The recall affects two separate vehicle lines. China’s State Administration for Market Regulation announced the plans on Friday.

The first group includes 44,535 Tang series SUVs manufactured between March 2015 and July 2017. These vehicles have design problems that could cause certain parts to malfunction.

The second batch covers 71,248 Yuan Pro electric vehicles built from February 2021 to August 2022. Battery installation issues in these cars could create fire hazards.

BYD plans to inspect and replace the faulty components at no cost to owners. The company will roll out fixes in stages to ensure adequate parts supply and minimize customer wait times.

A Pattern of Safety Issues

This recall adds to a growing list of quality concerns for BYD. In January 2025, the company recalled 6,843 Fangchengbao Bao 5 plug-in hybrid SUVs over fire risks.

Just months earlier in September 2024, BYD pulled roughly 97,000 Dolphin and Yuan Plus EVs from the market. Those vehicles had steering control defects that could also lead to fires.

The repeated recalls raise questions about manufacturing standards as BYD scales up production. The company faces fierce competition from Tesla, Nio, and XPeng in both domestic and international markets.

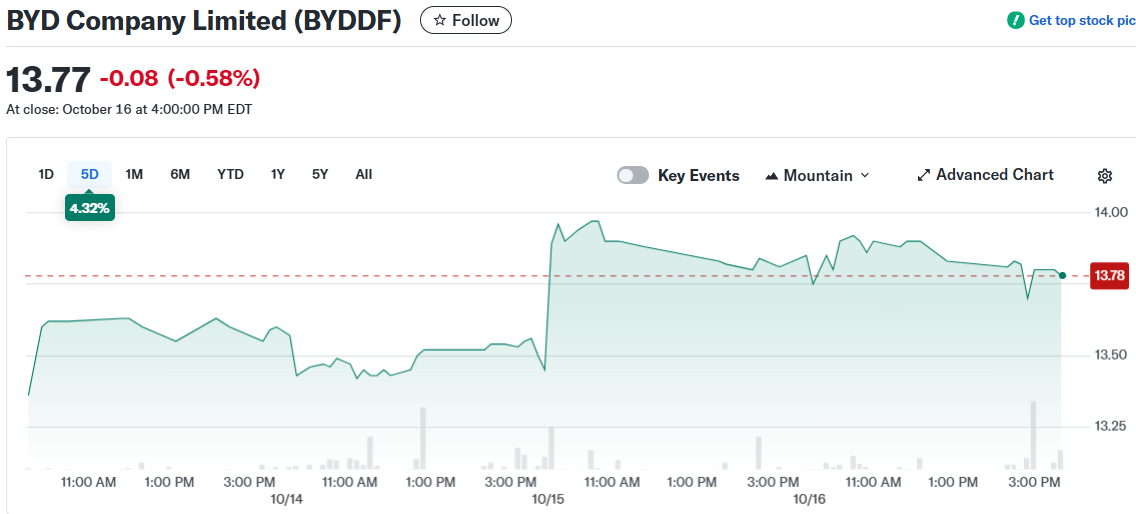

BYD stock dropped nearly 4.5% following the recall announcement. Shares have fallen 32% from their May 2025 peak.

Wall Street Sees Recovery Ahead

Despite recent troubles, analysts maintain confidence in BYD’s long-term prospects. Morgan Stanley points to the company’s overseas expansion as a bright spot.

BYD sold approximately 700,000 units outside China in the first nine months of 2025. The company appears on track to hit its full-year target of 900,000 to 1 million international units.

Morgan Stanley projects BYD will sell between 1.6 million and 1.8 million vehicles outside China in 2026. That would represent growth of 68% to 89% year-over-year.

The investment bank notes that heavily shorted positions could fuel a sharp rebound if sales improve. They expect inventory challenges to ease in coming months.

Wall Street analysts give BYD a Moderate Buy rating based on seven Buy and three Hold recommendations. The average price target sits at $24.90, suggesting 80.83% upside from current levels.

BYD reported a small 0.9% decline in vehicle production for July 2025. This marked the first monthly drop in over 16 months, though sales still increased 0.6%.

The company plans to start production at its new Hungary plant by the end of 2025. BYD is currently offering discounts on Qin Plus sedan models through year-end.