TLDR

- CaliberCos completed its first Chainlink token purchase as part of a new Digital Asset Treasury strategy

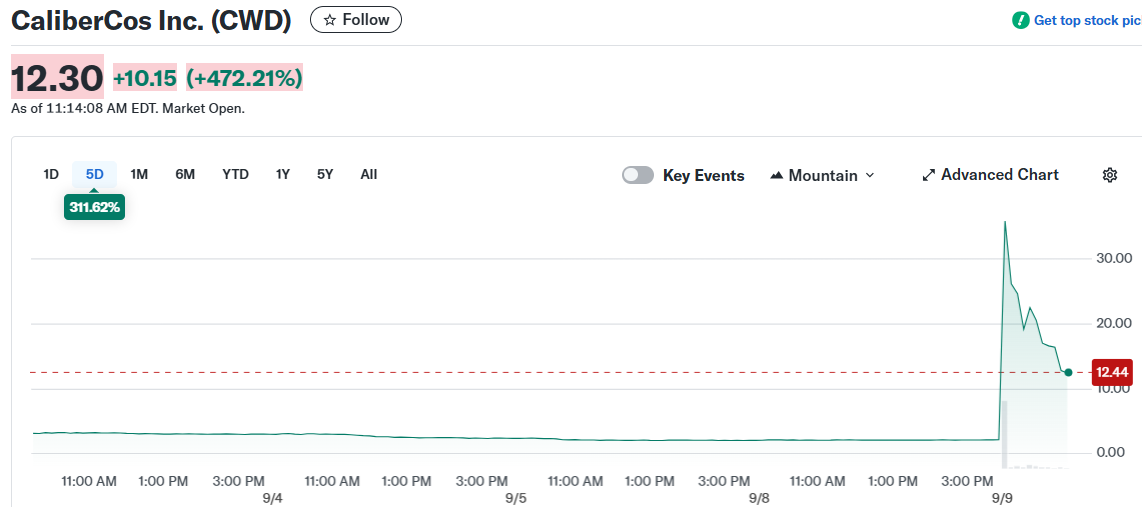

- CWD stock jumped 856% on Tuesday with over 79 million shares traded versus usual 9.6 million daily volume

- Company plans gradual LINK token accumulation using equity credit line, cash reserves, and equity securities

- CaliberCos becomes first Nasdaq-listed firm to publicly announce Chainlink-focused treasury policy

- Stock remains down 83% over the past year despite Tuesday’s massive rally

CaliberCos stock exploded on Tuesday after the real estate and digital asset management company announced its first Chainlink token acquisition. The purchase marks the launch of the company’s Digital Asset Treasury strategy, triggering a stunning 856% stock price increase.

$CWD CaliberCos surges over 2,000% after completing its first Chainlink $LINK token purchase under a new digital asset treasury strategy.

The plan will be governed by a Crypto Advisory Board, making Caliber one of the first U.S.-listed firms to adopt such a model. pic.twitter.com/EudfZmmfqI

— Ticker Wire (@Tickerwire) September 9, 2025

The initial transaction served as a system test as CaliberCos rolls out its broader plan to accumulate LINK tokens over time. Trading volume surged to 79.31 million shares, far exceeding the typical daily average of 9.69 million shares.

CWD shares had been struggling before the announcement. Despite being up 30.76% year-to-date prior to Tuesday’s rally, the stock had fallen 82.94% over the past 12 months.

The company aims to generate long-term appreciation and current yield through staking these digital assets. By adopting LINK into corporate reserves, CaliberCos strengthens its position at the intersection of real-world assets and blockchain infrastructure.

CaliberCos plans to fund future purchases through multiple channels. These include its equity line of credit, available cash reserves, and the issuance of equity-based securities.

Historic Blockchain Treasury Move

CaliberCos has positioned itself as the first Nasdaq-listed company to publicly disclose a treasury policy centered on Chainlink. This move provides shareholders with direct exposure to LINK token market value.

CEO Chris Loeffler explained the company’s approach to the Chainlink acquisition program. “Each acquisition reinforces our conviction in Chainlink as the infrastructure connecting blockchain with real-world assets,” he said.

The executive described the strategy as designed around gradual, measured acquisitions. This approach allows the company to average into the market while building its LINK treasury responsibly.

Loeffler emphasized that the initial purchase was designed to test internal systems before scaling operations. “Caliber’s Digital Asset Treasury strategy represents a disciplined, institutional approach to building a LINK position,” he explained.

The framework includes comprehensive tax, accounting, custody, and governance measures. This institutional approach aims to differentiate CaliberCos from more speculative crypto plays.

Market Reaction and Financial Concerns

Some reports indicated even larger intraday gains, with shares allegedly reaching a peak of $56 before settling at the closing price. This would represent a momentary 2,500% surge from previous trading levels near $2.10.

The timing of CaliberCos’ announcement followed a similar move by Eightco the previous day. That company announced plans to raise funds for Worldcoin purchases, sending its shares up over 1,400%.

Despite the enthusiasm from retail traders, analysts have expressed caution about the company’s financial stability. CaliberCos has reportedly seen revenues decline by more than 40% in 2024, while net losses widened by over 50%.

Wall Street analysts currently maintain a Hold rating on CaliberCos stock based on recent coverage. The consensus price target sits at $2.50, though Tuesday’s rally has pushed shares well above that level.

Market commentators suggest the stock may appeal more to speculative investors rather than those seeking stable long-term value. Limited analyst coverage and governance questions add to the investment risks.

CaliberCos outlined its plan to steadily grow LINK holdings through consistent, smaller purchases rather than large one-time transactions. This measured approach allows the company to average into the market while managing volatility.

The strategy also enhances the company’s long-term staking capabilities as it builds a material position in LINK tokens. Loeffler noted that ongoing acquisitions will be paced carefully over time.

The company’s premarket trading showed shares up 983.90% to $23.45 at last check on Tuesday.

The massive single-day gain represents one of the largest percentage increases for a Nasdaq stock in recent memory. However, the extreme volatility suggests investors should approach with caution.

CaliberCos’ initial LINK token purchase amount was not disclosed in the announcement. The company indicated future disclosures would provide more details as the treasury strategy develops.