Chainlink is heating up again, and so is the oracle narrative. After a choppy start to October, Chainlink jumped double digits as whales withdrew tokens and policymakers discussed friendlier rules. With Chainlink now near $18.70, traders are asking if oracle demand can power the next leg toward $35. Alongside Chainlink, PayFi newcomer Remittix (RTX) keeps trending as utility-focused capital rotates.

Chainlink Price Analysis: Institutional Interest

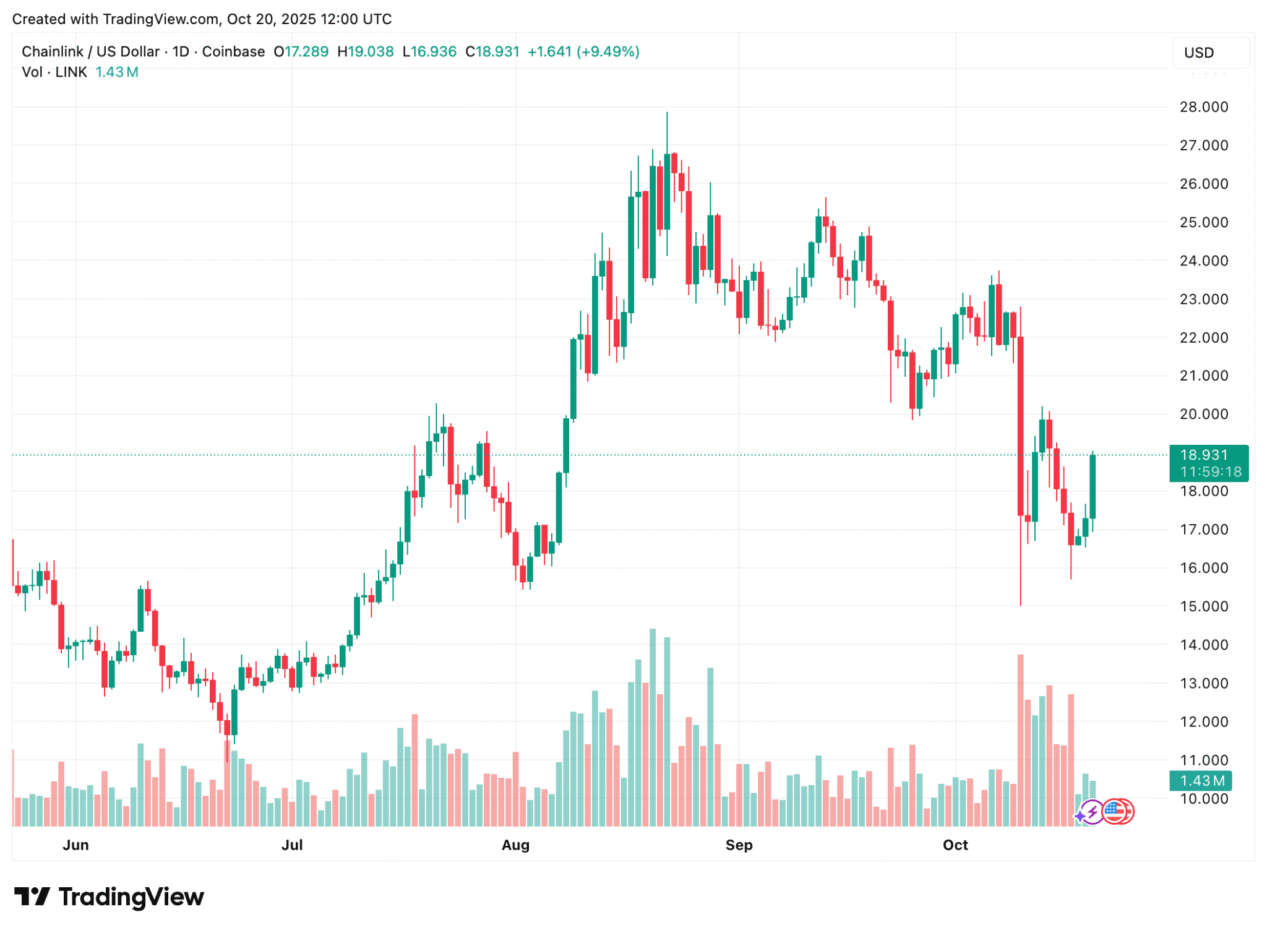

Chainlink price is now near $18.70. Chainlink has also recovered major trend lines after falling off the crash at $14, and has surged to the highs of $18.76 and higher. Bollinger midline of 20 days at $18.38 is serving as Bullish first support, and the 50-day EMA at $20.16 is the limit bulls desire to reach. A higher close that exceeds $20.16 per day would add more weight to an argument that the Chainlink recovery is headed towards a push to $23.31, and then $25.58.

Chainlink is experiencing momentum gains as RSI is now in the upper 60s and the negative MACD histogram is becoming faded, which indicates the loss of control by the sellers. Volume over $1.09 billion adds credibility to the move. If Chainlink slips under $18.50, watch $17.06 and $15.75 as support holds above $18.50, reclaim $20, and Chainlink keeps the $35 price prediction in play, especially if on-chain oracle calls keep growing.

Institutional interest in dependable data feeds continues to favor Chainlink. As DeFi, RWAs, and tokenization expand, Chainlink oracles remain the default for price and proof data. Recent whale withdrawals, over $15 million in LINK off exchanges, suggest accumulation rather than distribution. If Chainlink closes and holds above $20, a trend shift could attract momentum funds, reinforcing the Chainlink price prediction path toward $35 into year-end.

Remittix (RTX) in the Spotlight

While Chainlink is powering the oracle movement, Remittix (RTX) is driving the next phase of PayFi adoption. As investors look beyond data feeds toward tokens with practical, revenue-linked use cases, Remittix stands out for its real-world function: converting crypto into direct fiat bank payouts across 30+ countries.

Remittix has raised over $27.5 million, sold more than 679 million tokens, and is currently priced at $0.1166. The project is ranked #1 on CertiK for pre-launch tokens, confirming best-in-class security.

Key Highlights

- Real PayFi Utility: Enables cross-border crypto payments that settle as fiat in traditional bank accounts.

- Top-Tier Security: Ranked #1 on CertiK, showing unmatched trust and credibility before its full launch.

- Adoption Momentum: Over $27.5M raised and 679M+ tokens sold as investors back its working PayFi rails.

- Live Wallet Beta: Already handling user-tested transactions in real conditions.

- Market Fit: Positioned as the leading payment bridge between blockchain liquidity and the global banking network.

Conclusion: What Could Push Chainlink To $35?

Chainlink needs two ingredients to validate the $35 target, sustained closes above $20, then a follow-through over $23 to unlock $25 and higher. If oracle requests and integrations rise while policy clarity improves, Chainlink can keep climbing.

In parallel, Remittix’s PayFi metrics, with a $0.1166 price, over 679 million tokens sold, and over $27.5 million raised, show continued traction. For diversified exposure, combining Chainlink’s oracle growth with Remittix’s payment rails offers two different, real-utility angles on the same adoption wave.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.