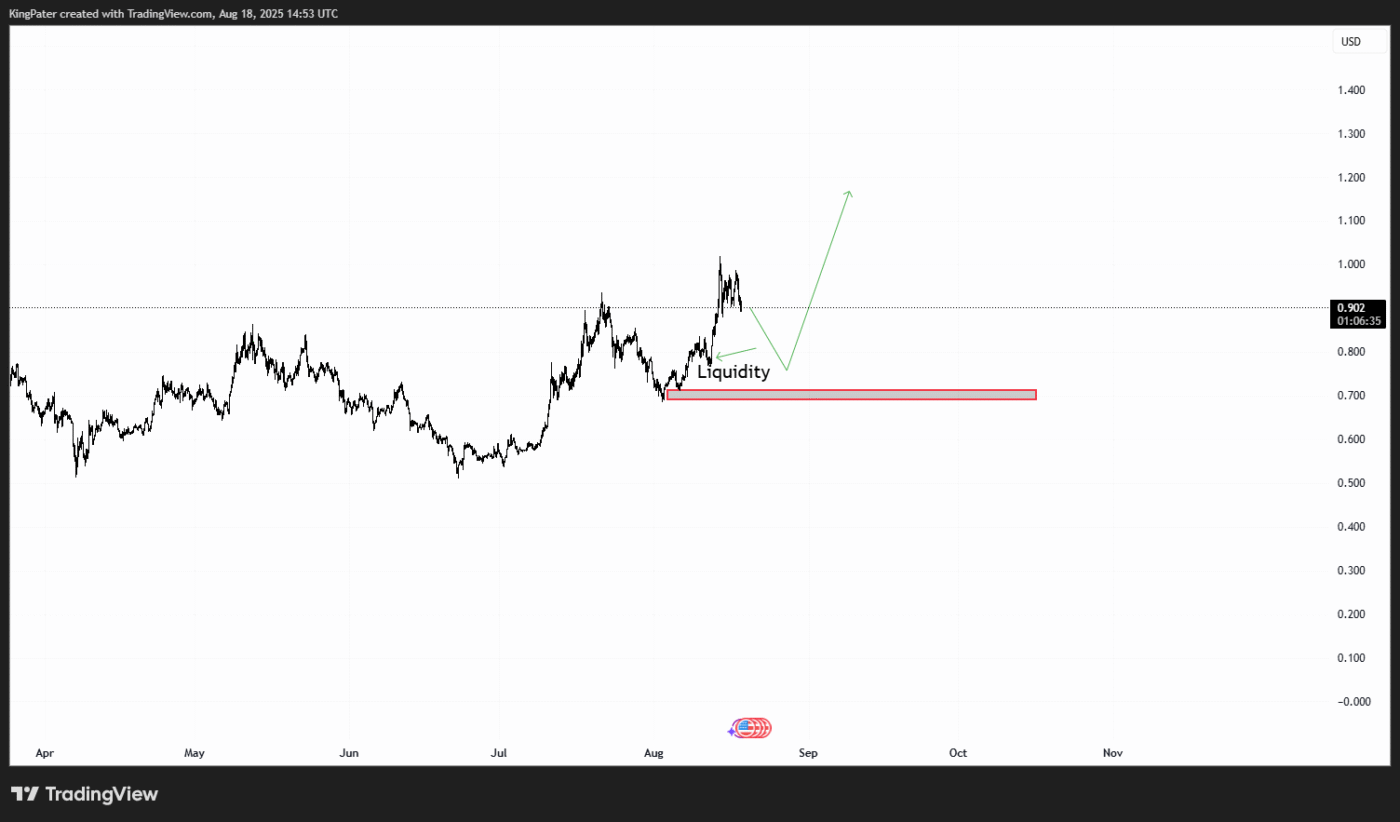

The cryptocurrency market saw sharp declines in the last 24 hours, with Cardano (5.8%) and Solana (5.7%) leading the downturn. According to Coinglass, more than $550 million in positions were liquidated, most of them long bets. Despite this, Unilabs Finance investors celebrated as its Stage 6 presale ended with Private desks calling it a safer haven amidst the broader bearish outlook.

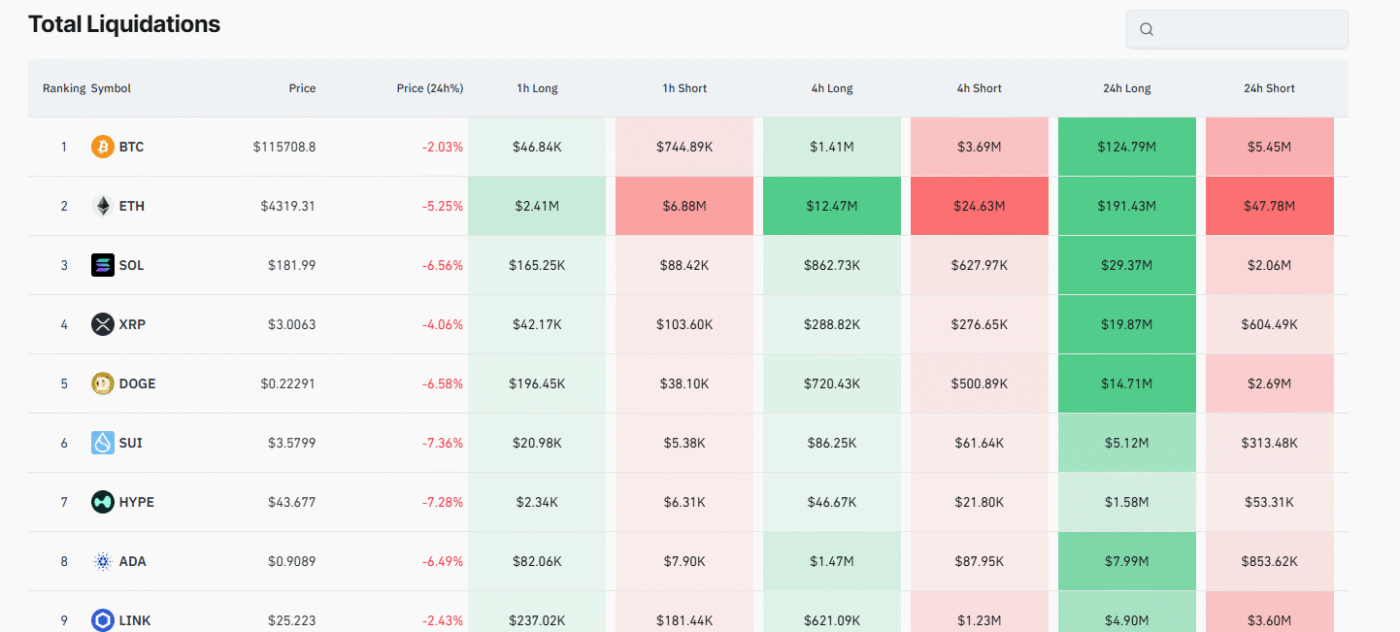

Solana Price (SOL) Fails to Break $200 Resistance

Solana’s price fell by as much as 5.7% after repeated failures to break the critical $200 resistance level. Solana Price fell to $180, accompanied by a 58% spike in trading volume. The rejection marked Solana’s second failure at $200 since August 15, invalidating a bullish inverse head-and-shoulders formation on the 4-hour chart.

On higher timeframes, technical analysts are divided on Solana’s next direction. Some believe the double top chart pattern formed in January could drive Solana’s price down below $100. Others, however, believe the $165 support should be enough to hold off any further crash.

Source: TradingView

Source: TradingView

Adding to bearish pressure, large investors have been moving coins onto exchanges. On August 17, more than 471,000 SOL (~$85.5M) flowed into trading platforms, the biggest single-day deposit since July. Galaxy Digital alone sent 224,000 SOL (~$40.6M) to Binance and Coinbase. Such whale inflows typically signal pending sell pressure, and with 94% of SOL holders still in profit after a 24% rally, profit-taking appears to be accelerating.

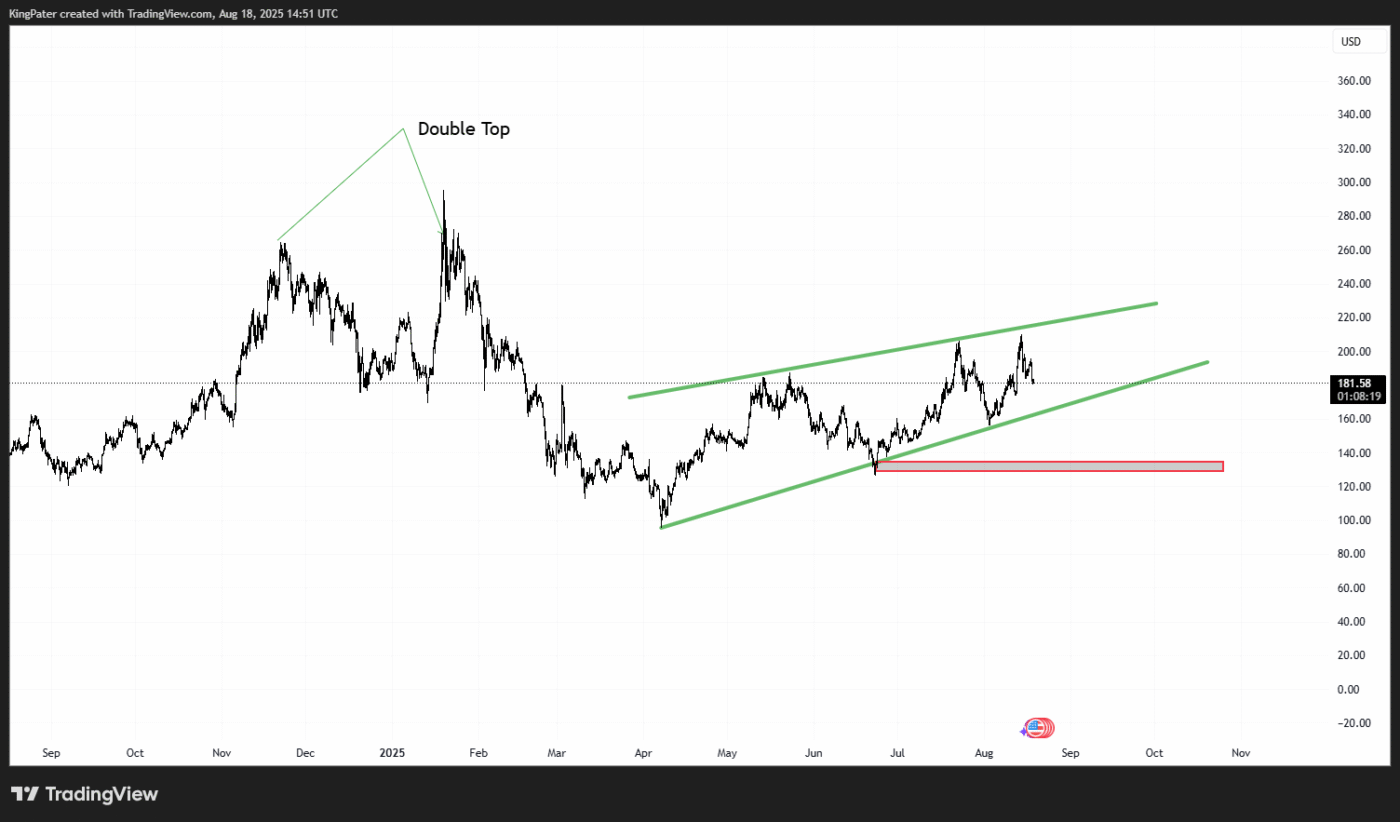

Cardano’s price (ADA) Weakening continues

Cardano, meanwhile, has quietly taken the steepest hit among major altcoins, slightly ahead of Solana (5.7%), Ripple (5%), and Dogecoin (4.7%). The Cardano price’s 5.8% decline highlights ongoing struggles for the network to maintain price traction in broader downturns. While Cardano’s price had seen modest recovery momentum in recent weeks, the latest drop underscores its vulnerability to sector-wide deleveraging and investors rotating into stronger narratives like Ethereum.

ADA has failed to break its $1 resistance level since March 4, and the short-term outlook points bearish. However, most market technicians agree that Cardano’s price support at $0.67 should hold, and if true, we could see Cardano break the $1 resistance towards the end of 2025.

Source: TradingView

Source: TradingView

For now, the question is whether buyers can defend critical supports in both Cardano’s price and Solana, or if this liquidation-driven selloff marks the start of a deeper correction and rotation into newer projects.

Unilab’s Presale Success Attracts Private Desks

After blazing through its 6th presale phase at record speed, Unilabs Finance has now entered Phase 7 with not just strong momentum, but the attraction of private desks and whales. With the broader crypto market suffering a flash dip to start the week, Unilab’s investors had reasons to celebrate with the token’s price appreciation.

At its core, Unilabs Finance stands out for its AI-powered asset manager. This was designed to make sophisticated crypto investing accessible to everyone and is believed to give retail traders the same edge institutions have.

Its proprietary engine scans on-chain and off-chain data, reading market signals, volume, social sentiment, and even meme-coin hype cycles. Beyond its data edge, Unilabs has built a structure that appeals to both retail and professional investors.

With four specialized funds: AI, Bitcoin, Real-World Assets (RWA), and Mining, users get the benefits of diversification without the complexity of managing multiple strategies themselves. Each fund is automatically balanced by the AI portfolio manager, ensuring that performance is optimized across market conditions. This “fund-of-funds” model has been a major driver of institutional-style confidence in the presale.

Token holders aren’t just betting on growth, they’re directly tied into the platform’s success. With a 30% revenue-sharing mechanism, UNIL holders earn passive income through fees generated on the platform. Add in staking rewards and governance rights, and you have a token that doesn’t just sit in a wallet but actively works for its holders. This mix of utility and incentives explains why Phase 6 closed so quickly.

Conclusion

Unilabs has already crossed $30 million in Assets Under Management and is being recognized as one of the fastest-growing crypto projects of 2025. Early backers have already seen massive multiples on their entries, while new investors are lining up as each presale round ticks upward in price.

Cardano and Solana’s price might be due for a correction but with Phase 7 underway at $0.0108, the window for low-entry opportunity in Unilabs FInance is narrowing fast. In a market where timing is everything, hesitation could mean missing out on one of 2025’s most exciting launches.

Discover the Unilabs Finance Presale:

Presale: https://www.unilabs.finance/

Buy Presale: https://buy.unilabs.finance/

Telegram: https://t.me/unilabsofficial

Twitter: https://twitter.com/unilabsofficial

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.