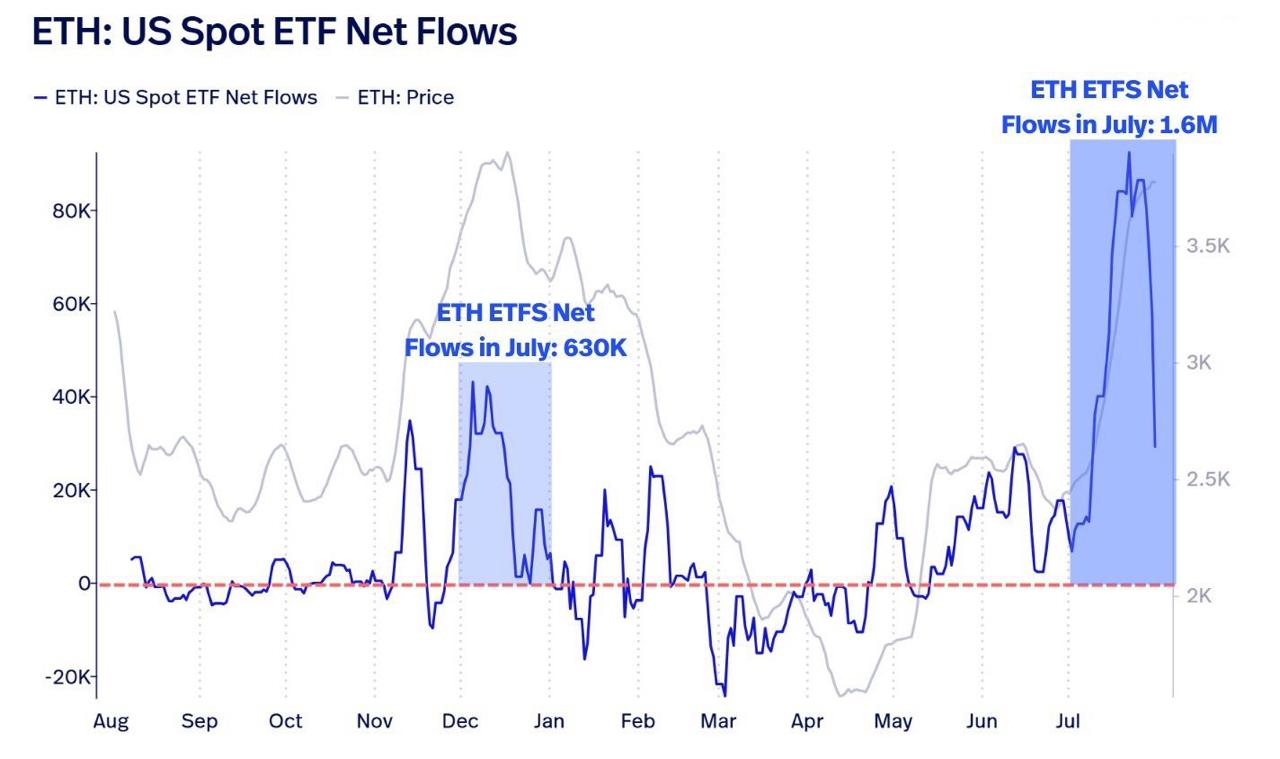

Ethereum ETFs shattered records in July 2025, drawing $5.43 billion in net inflows and fueling bullish momentum across the entire Ethereum ecosystem. As institutional capital floods in, ERC-20 coins are gaining traction for their real-world utility and interoperability with Ethereum’s infrastructure.

With ETH climbing from $2,400 to nearly $3,900 in July, ETF demand is tightening supply and amplifying upside potential for Ethereum-based assets. Analysts see this trend as a catalyst for high-utility tokens that offer more than speculation.

Ethereum ETF Surge Shifts Focus to ETH Infrastructure

Ethereum’s back-to-back 20-day inflow streak marks a turning point, outpacing Bitcoin ETF flows and highlighting Ethereum’s appeal as programmable money.

BlackRock’s ETHA fund alone accounted for $4.19 billion of those flows, signaling deep institutional belief in Ethereum’s long-term value.

ETH price has rallied nearly 60% on the back of these institutional flows. As Ethereum ETFs near 5% of total ETH supply, scarcity may drive prices past the $4,000 resistance zone.

BlackRock’s dominance in this space further validates ETH as core infrastructure for the future of finance, with ETFs offering institutions secure access to Ethereum’s smart contract ecosystem and staking rewards.

ERC-20 Tokens Ride the Institutional Ethereum Wave

As Ethereum ETFs expand, ERC-20 coins are seeing increased demand due to their seamless compatibility with institutional wallets and exchanges.

Coins like UNI, AAVE, and Remittix are benefitting from Ethereum’s rising dominance, as DeFi TVL surpasses $80 billion and staking continues to grow.

ERC-20’s standardized format and integration with regulated platforms give it an edge over non-Ethereum tokens. The ETH-ERC-20 price correlation has strengthened, and with more institutions entering the space, analysts expect to find the next 100x crypto among these Defi altcoins.

Remittix: Utility-Driven DeFi Crypto for Real-World Payments

Amid the ETF buzz, Remittix (RTX) is emerging as the institutional favorite among new ERC-20 tokens.

Unlike passive ERC-20s, Remittix generates value through real-world adoption. With Ethereum, Solana, XRP, and Cardano integrations, it’s a rare multi-chain PayFi solution built for enterprise-grade payments.

The September 15 wallet beta launch will include fiat settlement, low-fee transactions, and an enterprise API, shifting the focus from hype to function. RTX’s CertiK audit and tokenomics position it as a standout early-stage DeFi crypto with measurable demand.

Why Investors Are Flocking to Remittix

- Cross-Chain Utility: Ethereum, Solana, XRP & Cardano integration

- Wallet Beta Launch: Sept. 15 with fiat transfers & enterprise tools

- $17.9M Raised: Heavy institutional participation

- CertiK Audited: Zero critical issues

- Deflationary Model: Burn mechanism tied to transactions

Remittix is also fueling adoption through a $250,000 giveaway to early holders. The campaign has driven 480% wallet growth and $32M+ in processed transactions, validating real demand and making it one of the best cryptos to buy now before centralized exchange listings begin.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.