TLDR

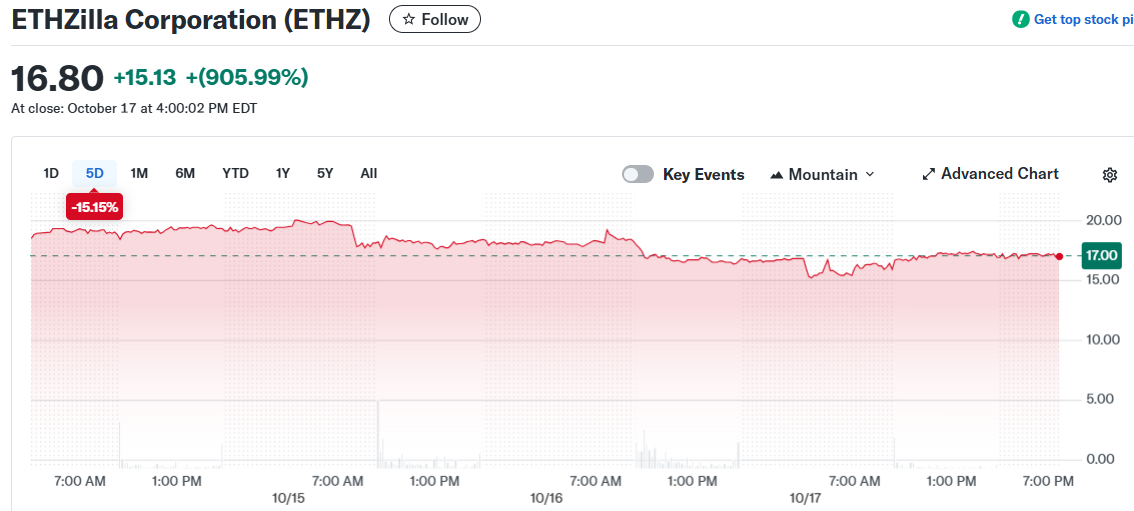

- ETHZilla Corp (NASDAQ: ETHZ) completed a 1-for-10 reverse stock split on October 20, 2025, raising its share price to around $16.80 to attract institutional investors.

- The company holds approximately 102,000 ETH worth over $400 million plus $215 million in cash and stablecoins in its treasury.

- Billionaire Peter Thiel’s 7.5% stake disclosure in August triggered a 207% single-day stock surge, though shares have dropped 15% in the past week.

- ETHZilla deployed $100 million into Ether.fi staking and $47 million into Puffer Finance while launching a $250 million stock buyback program.

- The stock remains up over 90% year-to-date despite recent volatility, with analysts projecting potential ETH price targets of $7,700 by 2026.

ETHZilla Corporation’s transformation from forgotten biotech to crypto powerhouse hit another milestone on October 20, 2025. The company’s 1-for-10 reverse stock split officially took effect, consolidating roughly 160 million shares down to 16 million.

Shares now trade around $16.80 on a post-split basis. That’s down about 15% from the previous week’s levels.

The reverse split wasn’t driven by compliance issues. ETHZilla designed the move to court institutional investors who typically avoid stocks trading below $10.

“As part of ETHZilla’s effort to expand engagement with institutional investors, the reverse split is designed to provide these investors access to collateral and margin availability associated with stock prices greater than $10.00,” the company stated. Many large mutual funds maintain minimum price thresholds regardless of market cap.

The Palm Beach-based company has built an impressive crypto war chest. It holds approximately 102,000 ETH in its treasury, worth over $400 million at current prices.

That makes ETHZilla one of the top six corporate Ethereum holders globally. The company also maintains around $215 million in cash and stablecoins ready for deployment.

ETHZilla’s journey started with a July rebrand from 180 Life Sciences. The biotech firm made a hard pivot to become an Ethereum-focused investment vehicle.

The strategy caught fire in August when billionaire Peter Thiel disclosed a 7.5% stake. Shares rocketed 207% in a single trading session as news of Thiel’s backing spread.

Putting Ethereum to Work

The company isn’t just holding crypto. It’s actively deploying assets into DeFi protocols to generate yield.

ETHZilla committed $100 million of its Ethereum into Ether.fi, a liquid staking protocol. This allows the company to earn staking rewards while maintaining flexibility through tradeable tokens.

The firm then allocated another $47 million into Puffer Finance. This protocol uses “restaking” to compound returns beyond baseline staking yields.

“Beyond baseline staking rewards, Puffer takes advantage of compounding and selling strategies to maximize returns,” explained Amir Forouzani, a Puffer contributor. The goal is boosting annual yields into high single or double digits.

ETHZilla secured a $350 million convertible debenture in September. That cash injection bolstered its balance sheet for future moves.

The company also launched a $250 million share buyback program. To fund repurchases without selling crypto, ETHZilla borrowed $80 million from Cumberland/DRW using part of its Ether holdings as collateral.

This allowed them to buy back about 2.2 million pre-split shares at around $2.50 each. Management calculated the stock was undervalued, with net asset value around $3.99 per share based on total assets.

Executive Chair McAndrew Rudisill said the buyback “underscores our commitment to maximizing value for shareholders.” The company also added Jason New, Vice Chairman of Investment Banking at Lazard, to its board this month.

Market Reaction and Risk Factors

The reverse split announcement initially spooked some investors. Shares fell over 5% the following trading day.

However, management emphasized this wasn’t a desperation move. The split doesn’t change proportional ownership or underlying company value.

Despite the recent pullback, ETHZilla stock remains up over 90% year-to-date. That vastly outperforms the S&P 500’s roughly 13% gain in the same period.

The volatility has been extreme throughout. After peaking in mid-August, the stock fell over 84% from its high by early October.

Technical analysts flagged the stock as “very high risk.” Daily trading ranges have frequently swung 8-10% or more.

ETHZilla itself acknowledged the correlation risk. “ETHZilla’s stock price may be highly correlated to the price of the digital assets that it holds,” the company warned in an SEC filing.

That’s a double-edged sword. If Ethereum soars, ETHZilla’s assets could appreciate dramatically.

If crypto crashes, the company’s valuation could deteriorate just as fast. There’s also execution risk around DeFi protocols and potential smart contract vulnerabilities.

Some analysts see upside potential. Wall Street’s interest in Ethereum is growing, with major firms pursuing Ethereum ETF approvals.

Analyst Rhys Northwood projects ETH could reach $7,700 by 2026 as institutional adoption accelerates. That would roughly double Ethereum’s current price and dramatically boost ETHZilla’s asset values.

“Thiel’s 7.5% ETHZilla stake signals a broader shift to Ethereum as a yield-generating asset,” noted research firm AIvest. Public companies now hold over 1.74 million ETH valued at $6.5 billion on their balance sheets.

Others remain cautious. “We’re in uncharted territory – it’s essentially a crypto ETF plus an active DeFi hedge fund rolled into one stock,” said one crypto investment strategist.

The company has limited operating history in this new domain. Its fate hinges almost entirely on Ethereum’s performance and DeFi execution.

Regulatory changes remain a wildcard. U.S. regulators have been favorable so far, classifying Ether as a non-security utility token in 2025.

However, global rules for corporate crypto treasury operations are still evolving. Any regulatory shifts could impact ETHZilla’s strategy.

The stock has dropped in seven of the last ten trading days. Momentum indicators recently hit oversold levels, which sometimes precede bounces but can also signal extended declines.

ETHZilla reports Q3 2025 earnings on October 23. Investors will be watching for details on revenue from DeFi deployments and future acquisition plans.