One of the benefits of cryptocurrency trading is that it is possible to make money when the markets are falling. This can be done by initiating short trades. Shorting simply means to initiate a SELL trade on an asset, in order to benefit from falling prices.

When shorting Bitcoin or any other altcoin, it is important to have the trade entry as close to the current peak of the price of the coin as possible, trade exit should be done below this peak at a point that can provide a decent profit. Timing is especially important when goings against the rise of the crypto market.

Please Note: This is a Press Release

What Must Be Considered Before Shorting a Cryptocurrency?

Certain considerations must be made before a decision is made to short Bitcoin or any other altcoin. These considerations are part of a trading checklist. Some of the questions on this checklist are as follows:

- What is the trend on the weekly and daily charts?

- Is the price close to a resistance?

- Has the price broken through a recent support level? Is there a pullback to this broken support?

- What are the trend and momentum indicators saying? Is there a negative divergence? Is price at overbought areas?

- Is it possible to trace a downtrending trendline or channel on the price action?

- Are there any bearish reversal or continuation patterns on the chart? For instance, is there a descending triangle or rising wedge forming on the charts?

- Can a price objective be determined in the presence of a chart pattern?

- Have any tops formed on the chart?

- Can a Fibonacci retracement tool be traced accurately on existing price action? Is price at a maximum retracement point?

These are questions that must be answered by any trader attempting a short trade on Bitcoin or any other altcoin for that matter. Let us now demonstrate the use of such information to actually set up a short trade. It must be mentioned that volume is not an important consideration in short trades, as downside moves tend to be naturally aggressive.

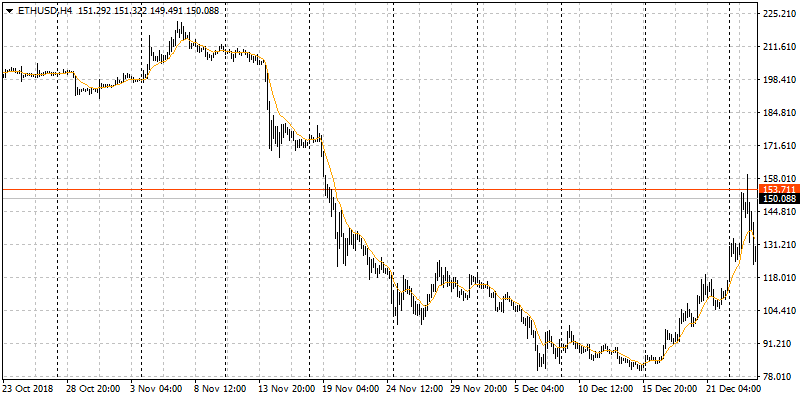

4-hour Chart: ETH/USD

Here is a 4-hour chart for ETH/USD. Can you spot anything that could justify some of the downside moves seen on this chart? Here is what we found.

First, it must be noted that there was a generalized bearish sentiment in the market. So the bias would naturally be to look for areas where shorting of the asset would be possible. Towards the top of the chart, a bearish pennant pattern stands out. If you take away the pole component of the pennant, you are left with a symmetrical triangle. Triangles and pennants are continuation patterns. Either way, the price is expected to continue downwards as far as this chart is concerned. So you would wait for a break of the price below the lower border of the pennant or the symmetrical triangle. This would provide the first clear signal to short the ETH/USD asset. The typical price projection for a pennant is for the breakout move to be the same length as the pole. The same projection holds for a symmetrical triangle; the breakout move rivals that of the initial move prior to the triangle’s formation. Therefore, the profit target should mirror this. We have therefore marked the first TP area to coincide with a distance that matches the pole of the bearish pennant.

Moving on from there, we identify a bearish Gartley pattern, otherwise known as the “W” pattern or the XABCD pattern. In this pattern, the price is expected to move south from point D. This would, therefore, serve as a good point to short the asset. A re-entry opportunity also presented itself, as a line drawn across the price tops from point X to point D and extended into the future also provided a valid resistance line on which to make a future short trade. The re-entry short area was where this opportunity presented itself. As before, the projected move is expected to be approximately the same distance as the size of the X wave in the Gartley pattern. This was captured by the 2nd TP marked area. Incidentally, prices reversed at that point, showing that this would indeed have been the best area to exit the Gartley/re-entry short trade.

In both setups, the 10-day EMA (orange line) acted as dynamic resistance as it was located above the price bars.

What trading platforms offer the best conditions for shorting?

There is a good number of companies that allow shorting bitcoin and altcoins. And because there is so many of them, the task of selecting the best cryptocurrency broker is quite complex. To simplify for you the process, we have decided to make a list of reputable entities and we have compared their trading conditions and fees. The most important fee for us when going against the rise of cryptocurrencies is the spread. This fee is as you might already know the difference between the price for which you buy a sell contract and between the price for which you sell the contract back to the company.

If we planned to stay in our positions for a long time period, we would also need to take into consideration the swap, which is a fee that is charged to your position whenever you let the trade opened overnight. Since we plan to take advantage of the current downtrend of the crypto market, we want to get quickly in and out with our trades. We want them last for only a couple of minutes or hours. Staying longer in a short position on cryptocurrencies is extremely risky and we do not advocate such ideas.

The comparison below covers the offer of the following popular cryptocurrency platforms: eToro, Plus500, Forex.com, Markets.com, XTB.com and 24 option.

Spread for Bitcoin, Ethereum and Ripple

| Company | Bitcoin | Ethereum | Ripple |

| eToro | 27.37 | 2.38 | 0.008 |

| Plus500 | 34.95 | 1.9 | 0.006 |

| Forex.com | 40 | 5 | 0.8 |

| Markets.com | 140 | 14.98 | 0.03 |

| XTB.com | 49 | 2.36 | 0.006 |

| 24Option.com | 69.88 | 2.57 | 0.003 |

*The table is accurate to 11:00 GMT+1, 22.01.2019. The spread will differ at least a bit on different days.

As you can see from the table above, the spreads vary not only from company to company but also from coin to coin. That is why the best way to select a company is to first decide what cryptocurrency you want to short. Once you do that, make a list of companies with a good reputation. From this list do your research and find out what company has the tightest spread for your cryptocurrency.

When choosing the best platform for shorting coins, take also other aspects into consideration which might differ for each trader, such as supported language, charting software, cryptocurrency tradable not only against USD but also Euro or pound sterling etc.