TLDR

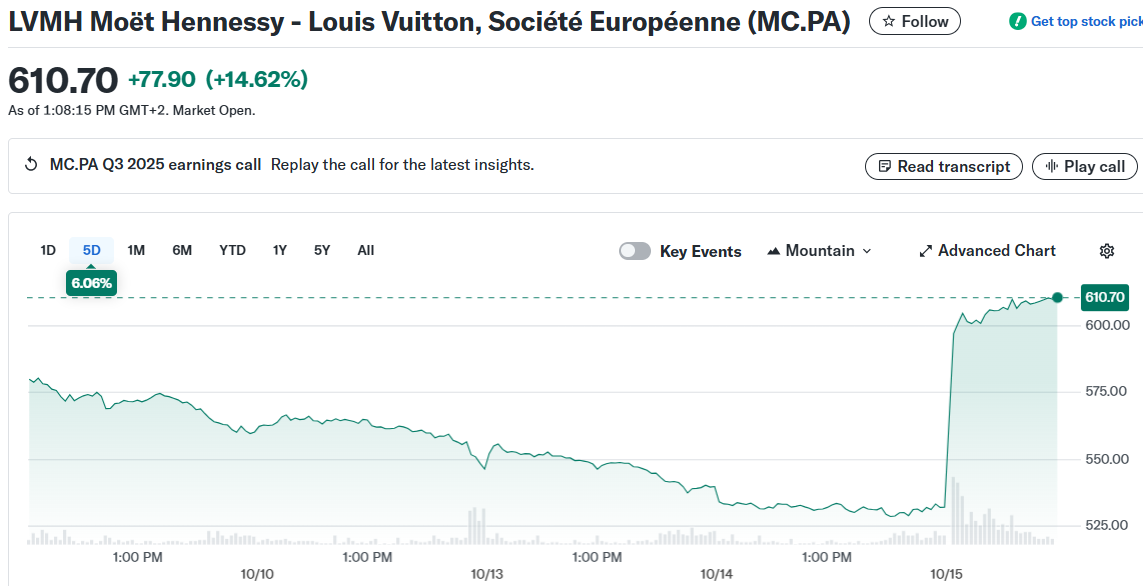

- LVMH stock jumped 14% on October 15, 2025, marking its biggest single-day gain since September 2001 after reporting unexpected sales growth.

- The company’s third-quarter revenue rose 1% on an organic basis, ending two consecutive quarters of declining sales.

- Sales in the region including China increased 2% after dropping 9% in the first half of 2025, suggesting demand recovery in this key market.

- The struggling wines and spirits division returned to growth after two-and-a-half years of declining revenue, helped by Champagne restocking in the US.

- Other luxury stocks surged following LVMH’s results, with Kering up 8.8%, Hermes gaining 6.3%, and Burberry rising 6.6%.

LVMH stock posted its largest single-day gain in nearly 24 years on October 15, 2025. The shares surged 14% in Paris trading after the luxury goods giant reported unexpected sales growth.

The company’s third-quarter revenue increased 1% on an organic basis. This marked the first quarterly growth in 2025 after two consecutive quarters of declining sales.

The results exceeded analyst expectations across all business divisions. Third-quarter revenue reached €18.1 billion, beating market forecasts.

LVMH’s return to growth sparked a rally across the luxury sector. Kering shares rose 8.8%, while Hermes gained 6.3% and Burberry climbed 6.6%.

The October 15 stock jump represented LVMH’s biggest intraday gain since September 2001. Investors viewed the results as evidence that the luxury spending slowdown might be ending.

China Drives Regional Recovery

Sales in the region that includes China increased 2% in the third quarter. This followed a 9% decline in the first half of 2025.

Chief Financial Officer Cecile Cabanis described Chinese demand as encouraging during an analyst call. The country has been a key driver of luxury sales growth historically.

Morningstar analyst Jelena Sokolova noted that Chinese consumers are “still sitting on a big chunk of savings post-Covid.” She sees potential for further pickup in demand.

Fashion and leather goods performed particularly well in China. Retail sales in the region contributed to growth for the first time in 2025.

US sales rose 3% in the quarter. However, European revenue slipped 2% as American tourists spent less due to a weaker dollar.

Champagne Sales Make a Comeback

The wines and spirits division returned to growth after 30 months of declining revenue. Champagne restocking in the United States helped drive the turnaround.

Sales of rosé wine also contributed to the division’s recovery. CFO Cabanis cautioned that fourth-quarter comparables will be tougher than the third quarter.

She added that 2026 comparables will be easier for the division. This suggests the wines and spirits business may have stabilized.

Total revenue for the first nine months of 2025 reached €58.1 billion. This reflected 1% organic growth and overall demand stabilization across key markets.

Louis Vuitton began offering makeup earlier in 2025, selling €140 lipstick that helped drive store traffic. The brand opened a ship-shaped flagship store in Shanghai called The Louis, which has drawn crowds.

LVMH appointed Jonathan Anderson as the new designer for Christian Dior Couture earlier in 2025. He oversees womenswear, haute couture and menswear.

Anderson unveiled his first women’s fashion show in October in Paris. His men’s designs will hit stores in January, with women’s collections arriving from the second quarter.

Fendi appointed former Dior womenswear designer Maria Grazia Chiuri as its new chief creative officer on October 15. Chiuri will unveil her first collection in Milan in February.

JPMorgan analyst Chiara Battistini said the pace of recovery from all regions is encouraging. Kering and Hermes will report sales next week, providing more evidence on demand conditions.