MutuumCardano (ADA) has long been a household name in the digital asset space, yet its price trend has struggled to break out of stagnation. Analysts following crypto charts and crypto prices today are pointing to Mutuum Finance (MUTM) as the standout alternative. Still in its presale phase at just $0.035, MUTM is gaining attention for its lending-driven framework designed to generate reliable returns for lenders while protecting the health of the overall system. This combination of growth and safety is being highlighted as a major reason analysts view it as the best crypto investment opportunity right now.

Lending Models That Drive Sustainable Income

Mutuum Finance (MUTM) is built around a dual lending structure, with Peer-to-Contract (P2C) lending forming the backbone of its stability. In this model, users supply liquidity directly to audited smart contracts and receive mtTokens, representing both their deposit and accruing interest. These mtTokens remain usable within the ecosystem as collateral or for staking, ensuring deposits never sit idle.

Consider an example where a depositor supplies $18,000 worth of BTC into the protocol. This deposit is converted into mtBTC 1:1, which then earns an average annual yield of around 15%. That translates into $2,700 of passive returns in just one year. At the same time, borrowers can post assets such as $1,200 in LINK as collateral and draw up to $900 in USDT through the system’s overcollateralized rules. Borrowers gain liquidity without needing to sell their holdings, allowing them to maintain exposure to potential gains while still meeting short-term funding needs.

Alongside P2C, Mutuum Finance (MUTM) also includes Peer-to-Peer (P2P) lending, which will serve as an outlet for more volatile assets. Tokens such as DOGE, PEPE, and FLOKI will be handled separately from the main liquidity pools to protect core solvency. Here, lenders and borrowers negotiate directly, with partial fills and higher rates reflecting the higher risk. This second channel adds further income opportunities for those willing to take on more exposure while keeping the central P2C pools safeguarded.

Collateral Rules, Liquidity Protections, and Why ADA Falls Short

Mutuum Finance (MUTM) has been designed with careful risk management rules, making its system attractive to both institutional and retail investors. The protocol applies a “Stability Factor” to determine the health of borrow positions, adjusting Loan-to-Value (LTV) ratios and liquidation thresholds according to the volatility of each asset.

Stablecoins and ETH, which carry lower risk, are expected to sustain LTVs up to 75% with an 80% liquidation threshold. On the other hand, more volatile tokens will be constrained to LTVs in the 35–44% range, with liquidations triggered closer to 65%. These parameters allow liquidators to step in profitably while ensuring the system maintains solvency during sudden price drops. Reserve factors will further protect liquidity, with safer assets carrying around 10% and higher-risk assets climbing as high as 45%.

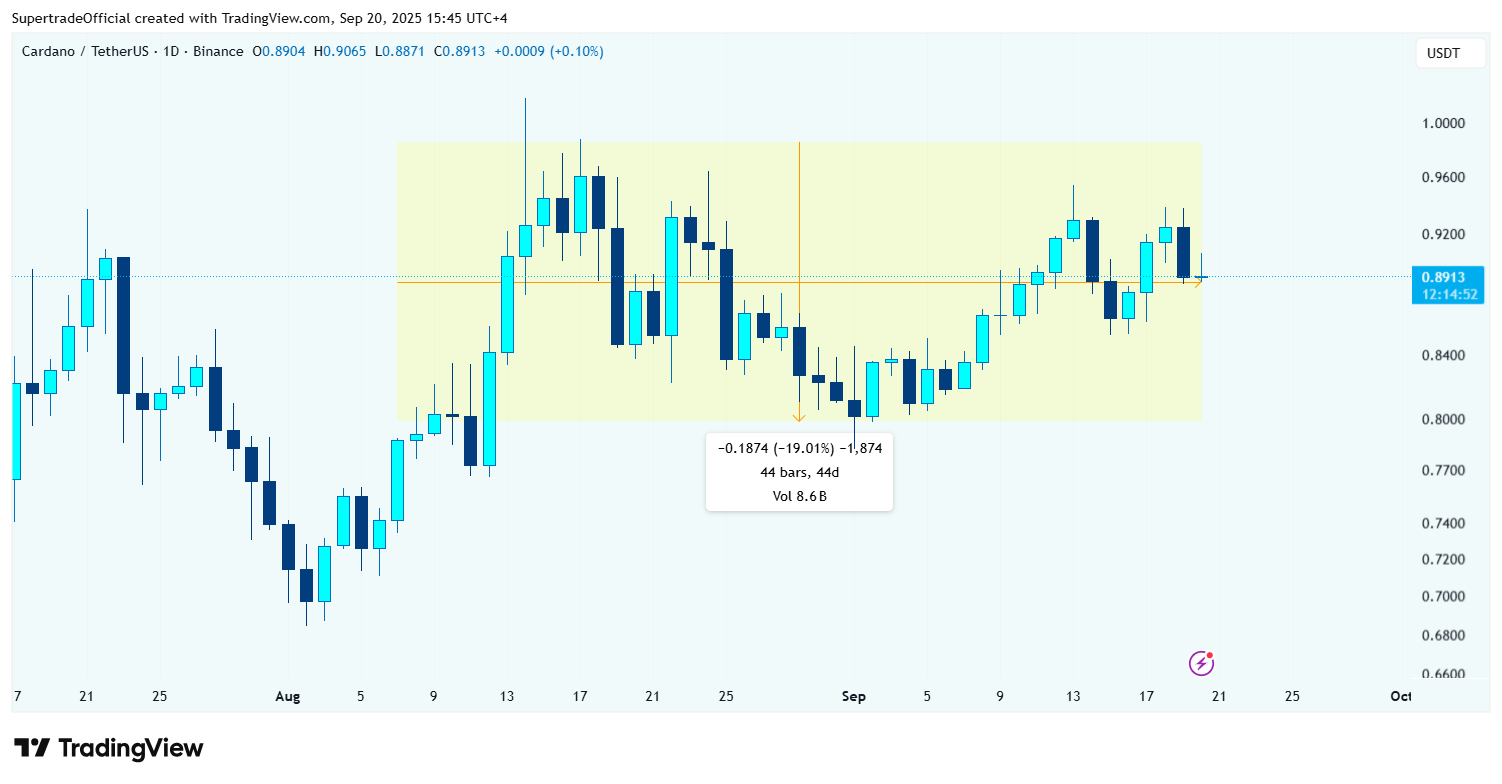

This balance between flexibility and safety is what gives Mutuum Finance (MUTM) its edge. ADA, despite being affordable and familiar, has shown limited progress in expanding its real-world use cases. Crypto prices today show ADA holding steady but uninspiring, leaving investors searching for projects with both growth potential and working mechanics. MUTM, by contrast, is still priced low yet already aligning itself with a lending model that fosters consistent demand and utility across market cycles.

At the heart of this momentum is liquidity management. On-chain liquidity ensures that distressed borrow positions can be liquidated without extreme slippage, and when markets turn volatile, the protocol can incentivize liquidators to step in with stronger rewards. This proactive design gives lenders confidence that their capital will remain secure, while borrowers know they can access liquidity without destabilizing the system.

Presale Momentum Strengthening the Case

The presale itself is already reflecting the growing confidence around Mutuum Finance (MUTM). Phase 6 has raised more than $16.1 million, with the token currently priced at $0.035 and 45% of the allocation sold to over 16,500 holders. Phase 7 is set to lift the price to $0.040, representing a 15% increase for early participants. Analysts looking at crypto investment trends note that those who joined during Phase 1 have already seen remarkable growth in value. For instance, an $8,000 AVAX swap then is now value $28,000 on paper, and this value is expected to rise to unrealized $48,000 once the presale closes at $0.06.

Adding to its credibility, Mutuum Finance (MUTM) has undergone a CertiK audit, scoring 90 in TokenScan and 79 on Skynet. The project is also incentivizing community engagement through a $50,000 bug bounty program, offering rewards up to $2,000 for critical findings, and running a $100,000 giveaway where ten winners will each receive $10,000 in MUTM tokens. These measures underscore its commitment to security and inclusivity while creating further excitement around its launch.

Why Analysts Favor MUTM Over ADA

When comparing crypto charts, it becomes clear why analysts tip Mutuum Finance (MUTM) as the best crypto to invest in at this stage. ADA has retained affordability but has failed to shake its flat trajectory. Mutuum Finance (MUTM), on the other hand, is coupling low entry pricing with a lending framework that generates real income for lenders, protects borrowers through clear collateral rules, and strengthens the entire system through liquidity incentives.

With Phase 6 still live at $0.035, MUTM stands out as the cheapest token in presale with working utility and institutional-grade design. Analysts conclude that this rare combination of affordability and proven lending models sets MUTM apart, giving it the advantage that ADA has so far been unable to deliver.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance