TLDR

- Rani Therapeutics (NASDAQ: RANI) stock jumped nearly 200% on October 17, 2025, after announcing a partnership with Chugai Pharmaceutical worth up to $1.085 billion.

- The deal involves developing an oral biologic drug using Rani’s RaniPill technology, which delivers injectable medications through a swallowable capsule.

- Rani received $10 million upfront and could earn up to $175 million in milestones for the first program, plus single-digit royalties on sales.

- The company raised $60.3 million in private funding, extending its cash runway into 2028 after previously having only $10 million in reserves.

- Wall Street analysts rate RANI a Buy with average price targets around $7-8 per share, though the stock remains high-risk and pre-commercial.

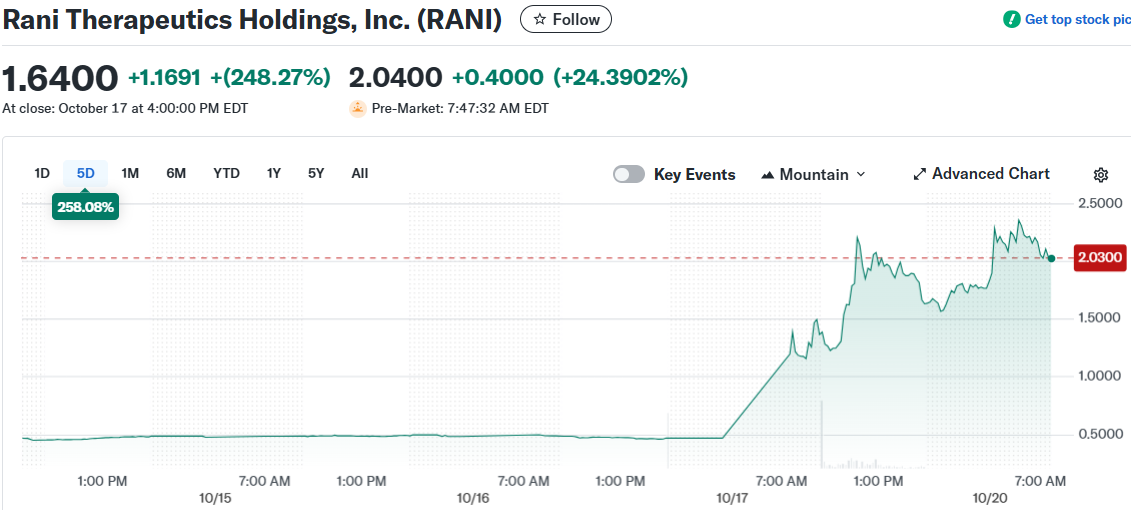

Rani Therapeutics stock exploded on October 17, 2025. Shares jumped from around $0.47 to an intraday high of $1.37, a gain of nearly 190% in a single session.

The company closed at $1.64 that day, up 248% from the prior close. Trading volume hit 70 million shares, compared to an average of just 318,000 shares daily.

The catalyst was a major partnership announcement. Rani signed a collaboration deal with Chugai Pharmaceutical, a Japanese pharma company majority-owned by Roche.

The deal centers on developing oral versions of biologic drugs using Rani’s RaniPill technology. Chugai will work with Rani to turn one of its injectable rare disease antibodies into a swallowable pill.

The financial terms caught investors’ attention immediately. Rani will receive $10 million upfront from Chugai.

The company can earn up to $75 million in development milestones for the first program. Another $100 million is tied to future sales goals if the drug reaches market.

Rani will also receive single-digit royalties on any product sales. Chugai secured options to add five more drug programs under similar terms.

If Chugai exercises all options and hits every milestone, the total deal value reaches $1.085 billion. That’s a massive number for a company that had a market cap under $25 million before the announcement.

The stock continued climbing in pre-market trading on October 20. Shares traded around $2.30, up another 40% from Friday’s close.

New Funding Shores Up Balance Sheet

Rani announced a second piece of good news alongside the Chugai deal. The company raised $60.3 million in a private placement of stock and warrants.

The fundraising was oversubscribed, meaning investor demand exceeded the initial offering size. Samsara BioCapital led the round with participation from RA Capital and other biotech-focused funds.

Shares were priced at $0.48 each, roughly matching the market price before the news broke. That’s a vote of confidence from institutional investors who could have negotiated a discount.

Even Rani’s Executive Chairman, Mir Imran, invested additional capital as part of the group. Imran is a well-known medical device inventor who founded the company.

The timing of this cash injection matters. As of June 30, 2025, Rani had only $10.2 million in cash on hand.

The company was burning through millions in quarterly losses. Without new funding, Rani faced serious questions about surviving the next few quarters.

The $60 million in new capital, combined with the $10 million Chugai upfront payment and expected near-term milestones, extends Rani’s runway into 2028. That’s a dramatic turnaround from potential insolvency to three years of operational funding.

CEO Talat Imran called it a “pivotal moment for Rani.” The funding from top-tier biotech investors “reflects growing confidence” in the company’s strategy, he said.

Existing shareholders face some dilution from the roughly 42.6 million new shares issued at $0.48. But the 3x jump in stock price more than offsets that pain.

How the RaniPill Works

The technology behind this deal is unusual. Rani’s RaniPill is essentially a robotic capsule that delivers injectable drugs orally.

Large biologic drugs like antibodies and peptides can’t normally be swallowed. Stomach acid destroys them before they reach the bloodstream.

The RaniPill solves this problem mechanically. Patients swallow the capsule like any other pill.

It travels through the stomach intact and reaches the small intestine. Once there, a trigger mechanism activates.

The capsule injects its drug payload directly into the intestinal wall using a tiny dissolving microneedle. Because the intestinal wall has few pain nerves, this internal injection is painless.

The drug enters the bloodstream through the intestine’s blood supply. The capsule itself passes through the digestive system normally.

Rani has already proven this concept works in humans. In a recent Phase 1 trial, the RaniPill delivered a peptide drug to 52 volunteers.

Over 70% of the drug dose reached the bloodstream. That’s close to the 100% bioavailability of a traditional injection.

No serious side effects were reported from the capsules. These results validate that Rani’s approach functions as designed.

The company has multiple programs in development. RT-102 is an oral version of parathyroid hormone for osteoporosis.

RT-111 delivers the antibody Stelara for autoimmune diseases. RT-114 is an oral GLP-1 hormone for obesity and metabolic disorders.

GLP-1 drugs like Ozempic and Wegovy have become blockbusters for weight loss. But they require injections, which limits their appeal.

Rani’s preclinical tests showed the RaniPill could deliver GLP-1 with equivalent bioavailability to shots. The company plans to start a Phase 1 trial of RT-114 in late 2025.

Chugai’s involvement validates Rani’s platform beyond internal development. A major pharmaceutical company is betting real money that this technology can work at commercial scale.

Analyst Views and Risk Factors

Wall Street analysts covering Rani are bullish after the Chugai deal. All three tracked analysts rate the stock a Buy.

Average price targets sit around $7 to $8 per share. That implies hundreds of percent upside from current levels around $1 to $2.

Stifel and BTIG have maintained Buy ratings with targets of $8 and $14 respectively. They cite the potential of Rani’s oral GLP-1 program and overall platform.

But analysts acknowledge this remains a high-risk bet. Rani has no approved products and zero revenue.

The company must navigate clinical trials, regulatory approvals, and eventual competition from much larger players. Any failure in key trials could devastate the stock.

Weiss Ratings had given RANI a Sell rating as recently as early October. These quantitative views remind investors that Rani’s turnaround depends entirely on execution.

The stock’s extreme volatility this week underscores its speculative nature. A 180% single-day jump is not normal for stable companies.

Traders who bought at $0.50 and sold near $1.50 made quick profits. But those gains can vanish just as fast if setbacks occur.

Still, the Chugai partnership changes Rani’s credibility profile. A Roche-affiliated pharma company doesn’t hand over potential billion-dollar deals lightly.

The next 1-2 years will be critical as Rani generates clinical data. Positive results could rapidly build investor confidence.

The company had been trading below $0.50 for months before this news. Even after the rally, shares remain down about 65% year-to-date.

That context shows how beaten-down RANI was and how transformative these developments appear. The stock had faced potential Nasdaq delisting due to low market value and share price below $1.

Trading back above $1 and boosting market cap should help Rani regain compliance. Pre-market action on October 20 showed shares around $2.30, suggesting continued momentum.