TLDR

- Tesla shareholders are voting on a potential $1 trillion pay package for Elon Musk at the Nov. 6 annual meeting, contingent on Tesla reaching an $8.5 trillion market cap

- Institutional Shareholder Services recommended voting against the 2025 compensation package, citing shareholder dilution and board independence concerns

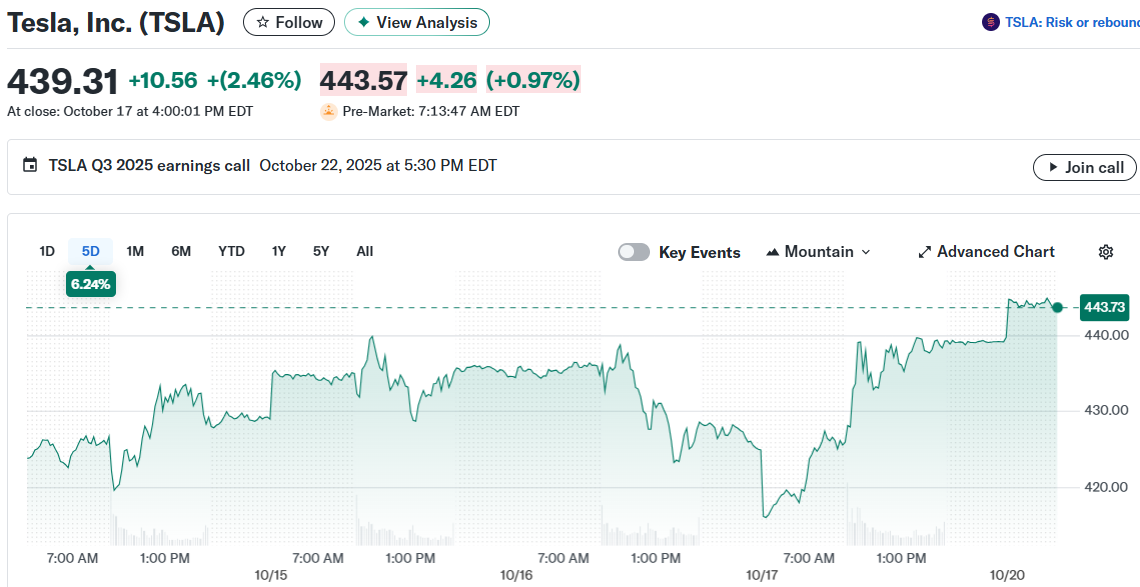

- Tesla stock rose 2.6% to $439.79 despite the ISS recommendation, breaking above the $400 resistance level with bullish technical momentum

- The company reports third-quarter earnings on Oct. 22, with Wall Street expecting 55 cents per share, down from 72 cents in the same quarter last year

- BNP Paribas initiated coverage with an “Underperform” rating and $307 price target, pointing to overreliance on unproven AI ventures like robotaxis

Tesla investors face a messy boardroom battle heading into next month’s shareholder vote. But the real action might be happening on the charts instead.

Shares climbed 2.6% to $439.79 on Oct. 20. The move came despite fresh criticism of Elon Musk’s proposed compensation package.

The 2025 pay award could be worth around $1 trillion if performance targets are met. Those targets include hitting an $8.5 trillion market cap.

That would put the stock price somewhere near $2,700 per share. Musk would receive roughly 425 million incentive-laden stock options.

Institutional Shareholder Services recommended shareholders vote no. ISS cited concerns about dilution and board independence.

This isn’t new territory. ISS also opposed Musk’s 2018 and 2012 compensation packages.

Shareholders approved both of those deals anyway. Wedbush analyst Dan Ives and Future Fund’s Gary Black expect the same outcome this time.

The vote happens Nov. 6 at Tesla’s annual meeting. But investors have something else to watch first.

Earnings Take Priority Over Pay Drama

Tesla reports third-quarter results on Oct. 22. Wall Street expects earnings of 55 cents per share.

That’s down from 72 cents in the same quarter last year. The company delivered 497,099 vehicles in the third quarter.

That was a quarterly record and up 7% year over year. The delivery numbers could help beat earnings estimates.

Investors will focus on fourth-quarter guidance. The federal $7,500 EV purchase tax credit expired at the end of September.

Tesla launched cheaper versions of the Model 3 and Model Y. Those moves aim to offset the lost tax credit.

Questions about the robotaxi expansion will also come up. Tesla launched the service in Austin, Texas, back in June.

AI computing powers Tesla’s self-driving technology. Those AI opportunities have fueled the stock’s 99% gain over the past year.

Technical Setup Shows Room to Run

The stock broke cleanly above the $400 level. That former resistance now acts as support.

The 50-day moving average crossed above the 200-day moving average. This golden cross pattern often signals a bullish medium-term trend.

Volume increased during recent up days. This confirms the breakout’s strength.

The Relative Strength Index sits below overbought territory. That suggests more upside potential exists.

Key resistance waits at $450 to $460. That zone rejected prices back in July.

A close above $460 on strong volume could open a path to $500. Failure to hold $400 to $410 support would pressure the stock lower.

A drop below that range could push shares toward $370. That level matches a prior consolidation zone from Q2 2023.

BNP Paribas started coverage with an “Underperform” rating. The firm set a $307 price target.

Analysts there see 29% downside risk. They point to overreliance on unproven ventures like robotaxis and the Optimus robot.

The bank argues market expectations exceed what near-term fundamentals can support. Even aggressive scenarios don’t justify current valuations in their view.

Tesla defended Musk’s pay package in a lengthy post on X. The company said ISS “completely misses fundamental points of investing and governance.”

The company stressed that Musk earns nothing unless the share price rises materially. Performance targets include delivering 20 million EVs cumulatively.

Other goals include 10 million active Full Self-Driving subscriptions. The package also requires delivering one million Optimus humanoid robots.

Ives maintains a Buy rating with a $600 price target. Gary Black sold his Tesla position around $360.

Black cited valuation concerns. The stock trades at about 180 times estimated next year’s earnings.

That’s up from roughly 70 times a year ago. Tesla sold 497,099 cars in the third quarter.