TLDR

- Market size of tokenized gold reached a record $2.57 billion, led by Tether’s XAUT and Paxos’ PAXG

- XAUT saw a $437 million increase in supply to $1.3 billion after Tether minted 129,000 tokens in August

- PAXG grew to a record market size of $983 million, driven by $141.5 million in net inflows since June

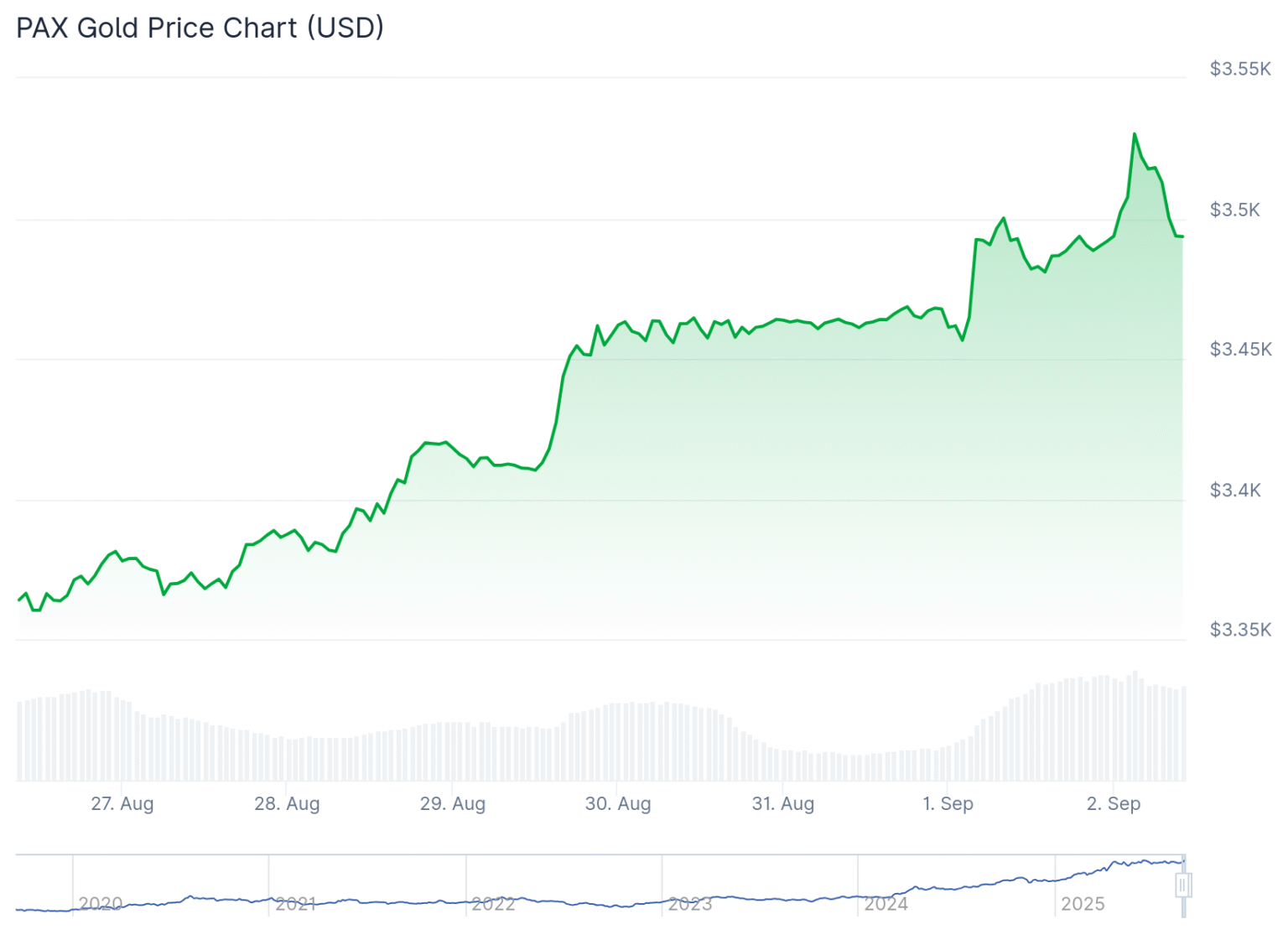

- Gold currently trades around $3,470, close to its April 22 peak

- Gold’s resurgence is linked to its safe haven status and a steepening U.S. Treasury yield curve

Gold is trading near its April record high, and tokens that represent the precious metal are hitting all-time highs in market capitalization. The total market for tokenized gold has reached $2.57 billion according to CoinGecko data.

This growth is primarily driven by two major players in the space: Tether’s XAUT and Paxos’ PAXG. Both tokens track gold prices and are backed by physical gold bars stored in vaults.

XAUT, issued by the same company behind the USDT stablecoin, has seen its supply jump by $437 million to reach a record $1.3 billion market cap. Blockchain data from Etherscan shows Tether’s Treasury minted 129,000 new XAUT tokens on the Ethereum network in early August.

Meanwhile, PAXG, created by U.S.-based stablecoin firm Paxos, has grown to a record market size of $983 million. This growth comes from $141.5 million in net inflows since June, according to DefiLlama data.

The physical gold that backs these tokens is currently trading at approximately $3,470 per ounce. This price point is just shy of the peak reached on April 22 earlier this year.

What’s Driving The Growth

Gold has long been viewed as a safe haven asset during times of economic uncertainty. Its recent price surge appears to be connected to a steepening U.S. Treasury yield curve.

The tokenized versions of gold offer crypto investors exposure to gold’s price movements without needing to deal with the logistics of physical storage. Each token represents ownership of a specific amount of physical gold.

XAUT and PAXG have become the dominant players in this niche market. Their growth reflects increasing investor interest in gold-backed digital assets as alternatives to both traditional cryptocurrencies and physical gold holdings.

Market Impact and Investor Response

The record growth in tokenized gold comes at a time when the broader cryptocurrency market has been experiencing volatility. Many investors appear to be turning to gold-backed tokens as a more stable store of value.

The $437 million increase in XAUT supply represents one of the largest minting events for the token. This substantial issuance suggests strong institutional demand for gold exposure in a tokenized format.

PAXG’s consistent inflows since June indicate sustained investor interest rather than a short-term trend. The $141.5 million in new investments demonstrates growing confidence in gold-backed tokens.

These tokens provide several advantages over physical gold, including easier transferability, divisibility, and potentially lower storage costs. They also offer more liquidity than traditional gold investments in some cases.

For crypto investors, these tokens present a way to diversify portfolios with an asset that has thousands of years of history as a store of value. The tokens combine gold’s stability with the technological benefits of blockchain.

The current gold price of $3,470 reflects multiple factors affecting global markets, including inflation concerns, geopolitical tensions, and changing monetary policies.

Gold’s proximity to its April high suggests ongoing strength in the market for the precious metal. The April peak occurred during what market analysts referred to as the “tariff tantrum,” highlighting gold’s role during periods of market stress.

The growth in tokenized gold appears to be part of a broader trend of bringing traditional assets onto blockchain technology. This process, often called tokenization, is expanding beyond gold to include other commodities and financial instruments.

The success of XAUT and PAXG may encourage more companies to launch similar products, potentially growing the overall market for tokenized precious metals in the coming months.

The current price level puts gold near its highest point in history, reflecting strong global demand for the precious metal across both traditional and digital markets.