TLDR:

- Bitcoin’s capitulation hits critical levels with $643M in realized losses and 46.08% of supply underwater.

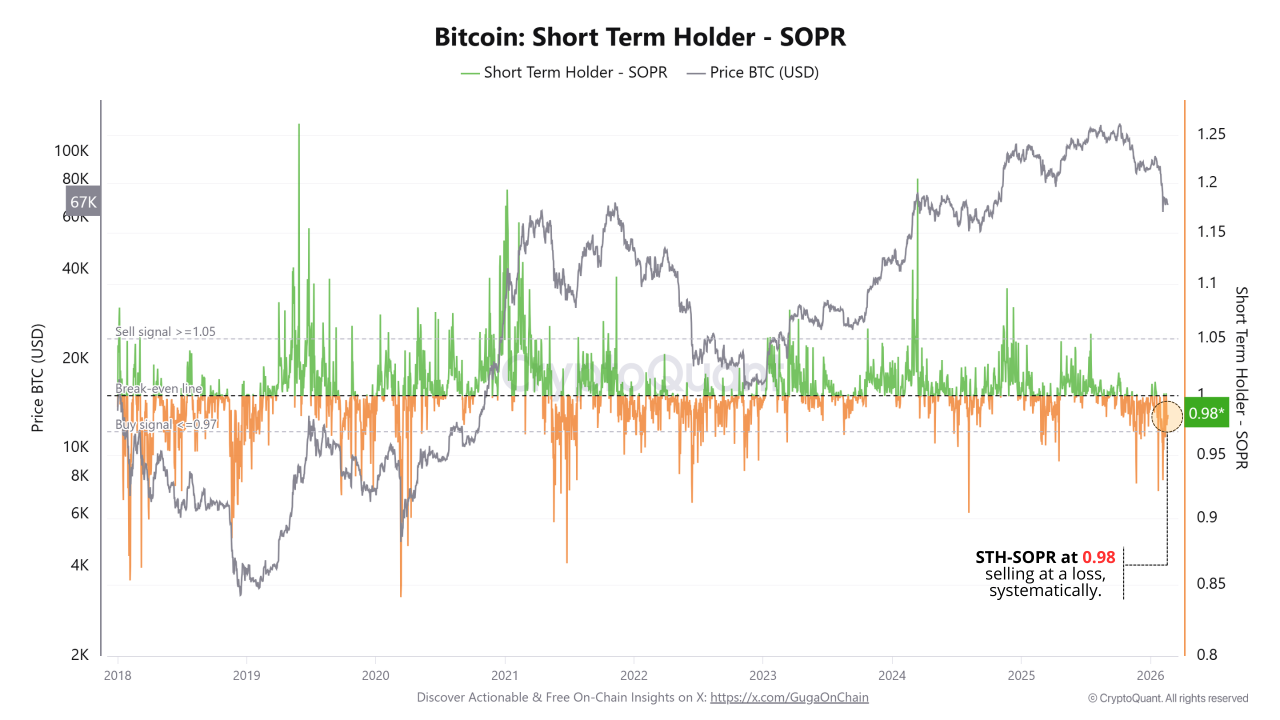

- Short-term holders with SOPR at 0.98 and MVRV at 0.73 are systematically selling BTC below entry price.

- Medium whales offloaded 91,580 BTC in 30 days while the Whale Ratio climbed to a telling 74% reading.

- Bitcoin ETFs recorded $404M in outflows Feb 17–19 as miners and retail quietly accumulated the sold supply.

Who is behind the selling pressure currently gripping the Bitcoin market? On-chain data now points to three specific groups driving the capitulation.

A total of $643 million in realized losses has been recorded, with 46.08% of the Bitcoin supply sitting underwater. The evidence is clear, this is not a broad market selloff.

Identifiable cohorts are responsible, and their behavior is trackable through on-chain metrics.

Short-Term Holders Are the Primary Source of Panic Selling

Short-term holders (STHs) sit at the center of the current capitulation. These are buyers who entered the market within the last six months, largely near cycle highs.

The STH-SOPR reading of 0.98 confirms they are selling consistently below their purchase price. Every transaction below 1.0 on this metric represents a realized loss being locked in by this group.

The STH-MVRV ratio adds further weight to this picture, currently reading at 0.73. That number reflects a cohort that is deeply underwater and actively exiting positions.

Rather than holding through the drawdown, these participants are choosing to sell at a loss. Their collective behavior is one of the clearest signs of active capitulation in the current cycle.

GugaOnChain’s on-chain analysis confirms that STH behavior is systematic, not isolated. The losses are being realized repeatedly across multiple sessions, not in a single spike.

This pattern suggests that fear, not strategy, is driving their exit decisions. It is the textbook behavior of speculative participants caught on the wrong side of the market.

Beyond the metrics, the timing of their entries matters here. Buyers from the last six months purchased Bitcoin when sentiment was elevated and prices were near local highs.

They are now facing significant paper losses that many are unwilling to hold through. That psychological pressure is directly translating into consistent sell-side volume on exchanges.

Medium Whales and ETF Institutions Are Amplifying the Pressure

Medium whales holding between 1,000 and 10,000 BTC have offloaded 91,580 BTC over the past 30 days. This is the most aggressive distribution coming from any single cohort in the current period.

Whales holding above 10,000 BTC have also reduced exposure by 22,280 BTC during the same window. Together, these two groups represent a coordinated and large-scale exit from the market.

The Whale Ratio currently sits at 74%, reinforcing that large players are routing significant volume toward exchanges.

This metric measures large transactions as a share of total exchange inflows. A reading this elevated has historically preceded continued downward price movement. It confirms that whale distribution is active and ongoing, not yet exhausted.

Institutional Bitcoin ETFs recorded $404 million in net outflows between February 17 and 19, 2026. These outflows directly translate into spot market selling pressure from regulated vehicles.

Institutions reducing exposure during periods of stress add a layer of selling that retail markets struggle to absorb. Their exit compounds the pressure already created by STHs and medium whales.

While these three groups lead the capitulation, a separate set of participants is moving in the opposite direction. Miners, small whales, and retail buyers are steadily accumulating the supply being offloaded.

This dynamic; where distressed sellers transfer coins to patient accumulators: is a recurring feature of Bitcoin’s correction phases. The identity of the sellers is now clear, and so is the identity of those stepping in to buy.