TLDR

- Crypto market dropped $133 billion to $3.98 trillion market cap following unexpected inflation data

- Bitcoin fell from record highs above $124,000 to around $118,800, triggering over $1 billion in liquidations

- Analysts view the pullback as healthy profit-taking rather than a trend reversal

- TeraWulf secured $3.7 billion AI data center deal with Google backing $1.8 billion for an 8% stake

- Coinbase completed its acquisition of derivatives exchange Deribit, expanding its trading offerings

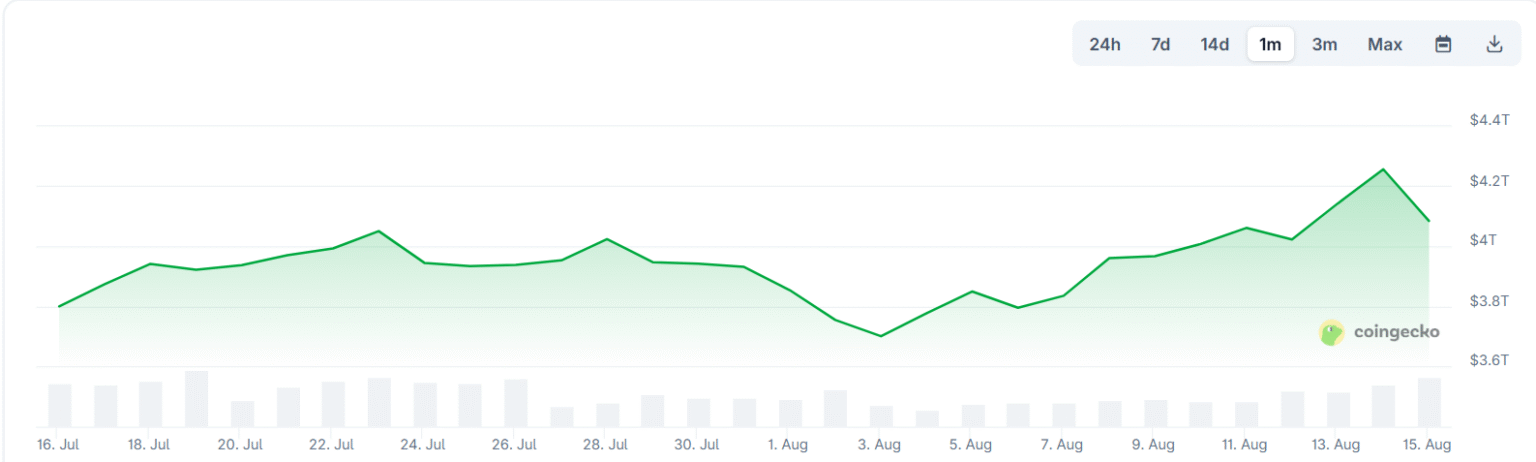

The cryptocurrency market experienced a sharp decline on Thursday as unexpected inflation data triggered widespread selling. The total crypto market cap fell by $133 billion to $3.98 trillion, erasing some of the gains from bitcoin’s recent record-breaking rally.

Bitcoin dropped from its all-time high of $124,474 to around $118,800, representing a 2.3% decline. The drop came after the Producer Price Index inflation report came in higher than expected, dampening hopes for aggressive Federal Reserve rate cuts in September.

The selling wasn’t limited to bitcoin. XRP fell 4.6% while ethereum performed relatively better with just a 0.7% decline. The CoinDesk 20 Index of largest cryptocurrencies dropped 2.1% over the 24-hour period.

This market movement triggered massive liquidations across crypto derivatives markets. Over $1 billion in leveraged trading positions were liquidated in 24 hours, with most being long positions betting on rising prices according to CoinGlass data.

This represents the largest long liquidation since the market downturn in late July and early August when bitcoin briefly fell below $112,000. Many traders who opened high-leverage positions after the recent rally were caught off guard by the sudden reversal.

Market Experts See Healthy Correction

Market strategists emphasized that the decline represents normal profit-taking rather than a fundamental shift in market sentiment. David Siemer, co-founder and CEO of Wave Digital Assets, described the move as “simply a recalibration in an otherwise bullish trend.”

“After such a sharp rally, profit-taking tends to set in, and we saw short-term traders liquidate their positions and take gains,” Siemer explained. He noted that bitcoin “remains firmly entrenched as the anchor of institutional crypto strategies.”

Joel Kruger of LMAX Group shared a similar assessment, calling the pullback unsurprising after “impressive moves in crypto markets this week.” He maintained that “the outlook remains highly constructive and dips should be well supported.”

The recent bitcoin rally was driven by several factors including rising expectations for Fed rate cuts, surging ETF inflows, and increased institutional adoption. These underlying fundamentals haven’t changed despite the short-term price action.

Bitcoin is currently holding above the support level of $117,261. Technical analysts suggest that maintaining this level is crucial for preventing further declines toward $115,000. A recovery above $120,000 could signal renewed upward momentum.

Major Developments Continue Despite Price Drop

While prices declined, several major developments occurred in the crypto space. TeraWulf announced a $3.7 billion deal with Fluidstack to develop an AI data center, with Google backing $1.8 billion for an 8% stake in the project.

The agreement provides 200 MW of IT load over ten years and could potentially expand to an $8.7 billion partnership. This represents continued institutional interest in crypto infrastructure despite market volatility.

Coinbase also completed its acquisition of derivatives exchange Deribit, which boosted the company’s stock price. The acquisition expands Coinbase’s offerings to include perpetual contracts and options trading, though these services are still in development.

Virtuals Protocol (VIRTUAL) was among the hardest hit, dropping 11.7% to $1.21. The token is currently holding above the critical support level of $1.14, which has proven important throughout this month.

If VIRTUAL maintains this support, it could potentially rise past $1.25 and possibly breach the $1.37 resistance. However, if selling pressure intensifies, the price may fall below $1.14, potentially slipping to $1.00.

The total crypto market cap is currently holding above $3.94 trillion, which analysts view as a potential support level for recovery. If this level holds, the market could see a bounce back toward $4.00 trillion.

However, widespread selling could push the market cap down to $3.89 trillion or lower, which would erase recent gains. This could potentially signal a more prolonged downturn affecting cryptocurrencies across the board.

Current market conditions suggest investors are taking a cautious approach, waiting for further economic data before making new positions. The market reaction to the PPI data shows sensitivity to inflation metrics and potential Fed policy changes.

The recent liquidations highlight the risks of leveraged trading in volatile markets. As traders reassess their positions, the market may see further consolidation before establishing a clear direction.