The long running Ripple SEC case has seen a positive shift after U.S. regulators dropped the “Bad Actor” label, restoring the token’s eligibility for certain exempt securities offerings under Regulation D. The decision has restored XRP price movement, while giving the token the ability to perform exempt securities offerings under Regulation D.

As the XRP price targets the $5 level, experts are still backing Unilabs Finance (UNIL). An AI asset manager that already boasts over 12.3 million in stage six. Let’s break down why market analysts remain cautious on XRP’s outlook while showing growing confidence in Unilabs’ potential.

Ripple SEC Lawsuit Decision Favors the Altcoin

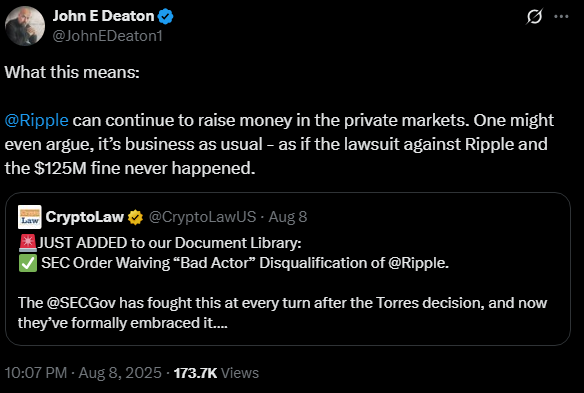

A key decision has been reached on the long-running Ripple SEC lawsuit. One that has seen XRP price regain an upward momentum, as the SEC waives the “Bad Actor” designation for the altcoin. The move will allow XRP to raise private capital.

The ruling comes only days after altcoin brought its five-year legal battle to an end. In its August 8 statement, the regulator said the decision was based on updated facts and the current situation. The disqualification had been made when the Ripple SEC lawsuit started in 2020.

Source: John E Deaton

Source: John E Deaton

According to the US SEC, the altcoin was believed to have violated Section 5 of the Securities Act. However, both Ripple and the SEC decided to have a settlement in May 2025, by asking the district court judge to dissolve the injunction.

As the Ripple SEC case settles down, the XRP price is already looking bullish. Santiment data notes that utility within the Ripple Ledger network has surged. This suggests more gains in XRP price could be on the way. Gains that might help drive the price of XRP towards $5.

However, despite the Ripple SEC lawsuit settlement and bullish outlook, some experts are still doubtful of the future performance of the altcoin.

Here Is Why Investors Are Loading Unilabs Finance Tokens Before It Launches

Unilabs Finance is positioning itself as a real game-changer within the DeFi sector. Unlike tokens that overpromise but end up under-delivering, Unilabs Finance offers a real-world AI-driven asset management platform. One that allows investors to easily diversify across different funds with just a single click.

The platform already manages over $32 million in AUM. It also offers passive income opportunities for UNIL holders through the revenue-sharing model. This unique model works by allocating 30% of its commission back to holders, creating a consistent passive income stream.

With an ongoing presale that has hit $0.0097, early investors are already enjoying a 142% ROI. According to experts, this impressive trajectory will continue with key listings.

Unilabs Finance To Outshine XRP Price Gains

While many reports only focus on Unilabs Finance AI trading capabilities, the truth is that it’s not the only driving factor behind the project’s success. Unilabs has also integrated risk-adjusted portfolio rebalancing, ensuring investors can easily adapt to market changes.

Its AI model utilizes both real-time and historical data, giving users an edge within the volatile markets. This strategic approach is quite rare among DeFi projects, making Unilabs stand out. Moreover, Unilabs also opens its features to retail investors.

This has helped drive strong investor interest, bringing in more than $12.3 million during the current presale stage. The Unilabs token is set to challenge the XRP price movement. Something that has seen many whales shift alliance, keeping in mind Ripple’s uncertain feature.

Conclusion

The resolution of the Ripple SEC dispute has removed a significant regulatory block that has been weighing on the XRP price momentum for years. But Ripple’s future remains uncertain as the market shifts to AI-driven DeFi opportunities like Unilabs Finance.

A shift that is making Unilabs a top investment option for 2025, with early investors cashing in big with a 142% ROI and a 50% bonus.

Discover the Unilabs Finance (UNIL) presale:

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.